Since the start of 2022, the bulk of any discussion around equity markets has begun with economic releases, and the Federal Reserve’s response to those releases. The main question on the line? When will the Fed stop raising interest rates.

When the equity markets are focused on the Federal Reserve before anything else, including corporate earnings, bad economic news is good news for the stock market.

That’s right, good news is bad news and bad news is good news.

Fewer people getting hired and wages not going up is not great news for the consumer but is does mean inflation should start to recede and the Fed can stop raising interest rates. Last year the Fed signaled that it will do whatever it takes to bring inflation back down to its target of 2% inflation. An economic recession just may be a side effect of those efforts. As we rolled into 2023, equity investors were rooting for a slowing economy. Each of the three months that made up the first quarter

of 2023 had a very different feel for how this was going to play out.

JANUARY

All economic releases in January continued with the trend we saw during the last few months of 2022, with all signs pointing to a slowing (but not a crashing) economy. Job growth was slowing, wages were not going up quite as fast and most importantly, inflation was falling. Bad news is good news! It was everything the stock market was looking for! And earning season was in line with expectations. It wasn’t great, but it wasn’t nearly as bad as feared.

January was optimistic, producing returns that matched that optimism. This peaked with the Federal Reserve meeting on February 1. They raised interest rates by 0.25%, and Jerome Powell’s press conference gave some hints that the Fed’s hiking cycle may be coming to an end. Equity markets continued to rally, and the narrative of a soft landing, with inflation falling in line without being accompanied by a severe recession, was a possibility.

FEBRUARY

That optimism did not last very long. The morning of Friday, February 3, provided investors with the January jobs report from the Bureau of Labor and Statistics. Economists had expected a gain of 187,000 jobs and that the unemployment rate would tick up from 3.5% to 3.6%. Instead, the report showed a gain of 517,000 jobs and the unemployment rate falling to 3.4%. That was the lowest unemployment rate since May 1969!

Was this report just an outlier, our did the slowing economy from the 4th quarter of 2022 just pick up in January? As February continued, additional economic releases reinforced the jobs report. Both measures of inflation (CPI and PCE) came in higher than expected, and retail sales were also much hotter than expected. The economy was indeed getting stronger. This was the dreaded “good news” the stock market feared. In this case, more people working (and spending those earnings) means the Fed has to raise interest rates even higher to tame inflation.

All of the optimism that was built in January was starting to evaporate, and the S&P 500 was now only up 3.4% for the year. The Nasdaq saw the 12.9% return trimmed down to a 9.4% return. The Dow Jones Industrial Average was now down 1.5% for the year. Markets feared that the Fed would have to raise interest rates

through the 2nd quarter, bringing the Fed Funds rate up to, or even over 6%, from its current level of 4.75%. If you thought February was volatile, just wait another week…

MARCH

There is an old saying that the Federal Reserve raises interest rates until they break something.

A few days into March, we started to see a few cracks.

- Silicon Valley Bank closed trading on March 7 at $267.83 per share. In just a few short days, the stock would be essentially worthless.

- On March 8, the bank announced a plan to raise over $2 billion in capital. Their bond portfolio had significant losses, and the bank needed to recapitalize. The vast majority of Silicon Valley Bank’s clients were in the same industry, and word spread quickly that the bank may be in trouble.

- At the end of the day on March 9, Silicon Valley Bank had more than $42 billion in withdrawals.

- On March 10, U.S. regulators took control of the bank. Just a few days later, Signature Bank suffered a similar fate. Bank stocks struggled, with regional banks leading the way down.

Welcome to the banking crisis of 2023.

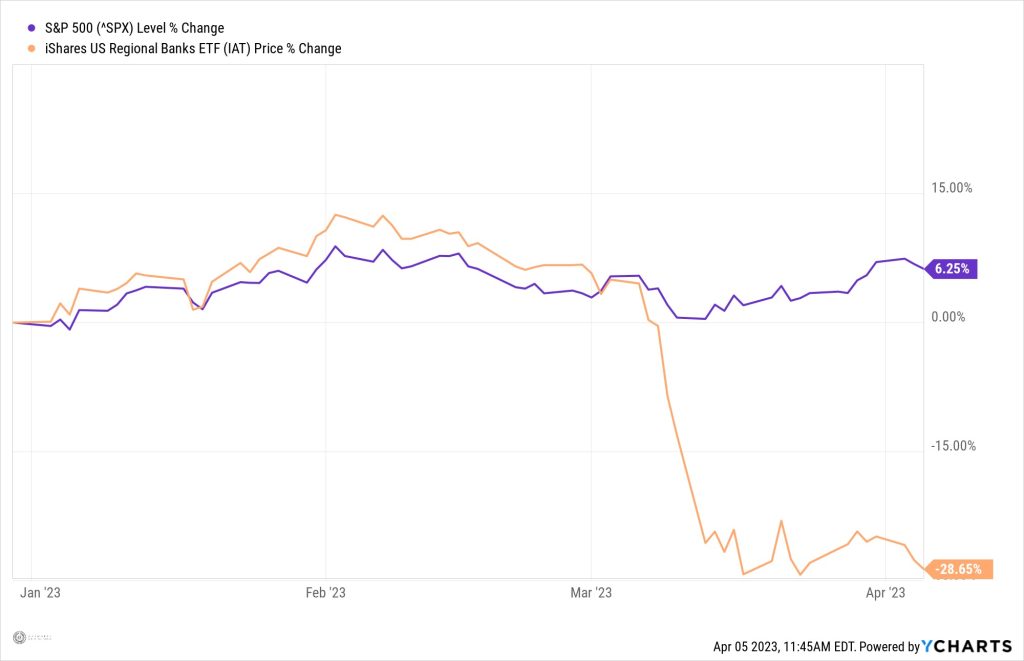

THE FALL OF REGIONAL BANKS VS S&P 500

Banks that were not deemed “too big to fail” saw deposits flee to the largest banks. In response, interest rates fell dramatically. The yield on the 1-year Treasury dropped from 5.25% down to 4.28% in just five trading days.

It is almost impossible for the stock market to have any stability when the bond market is this volatile.

At this point, the entire year-to-date gain for the S&P 500 had disappeared, and stocks were essentially flat for the quarter. On top of that, equity markets went from expecting a 0.5% increase in the Fed Funds rate to either a 0.25% increase or no change at all. In the end, the Fed did raise interest rates by 0.25%

but signaled a pause in rate hikes.

As of March 8, smaller banks that lost deposits did not have the ability to make as many loans, and many of the larger banks wanted

to reduce the risk on their own loan portfolios. The net result? Banks were going to slow loan growth. The banks were, in essence, going to help the Fed slow down the economy.

Before the banking crisis, the Fed Funds rate was expected to approach 6%. Now, we may see the Fed pause between 5% and 5.25%. It could be argued that the economy is better off with a “recipe” to bring down inflation that consists of a Fed Funds rate of 5% coupled with a more risk-averse banking sector than a Fed Funds around 6% coupled with a banking sector willing, or in some cases eager, to take on more risk. As we moved past March 14, and the feared contagion of the financial crisis was not materializing, markets began to recover and even ended with a nice rally. Once all the dust settled from a very eventful three months, we ended the quarter with a gain.

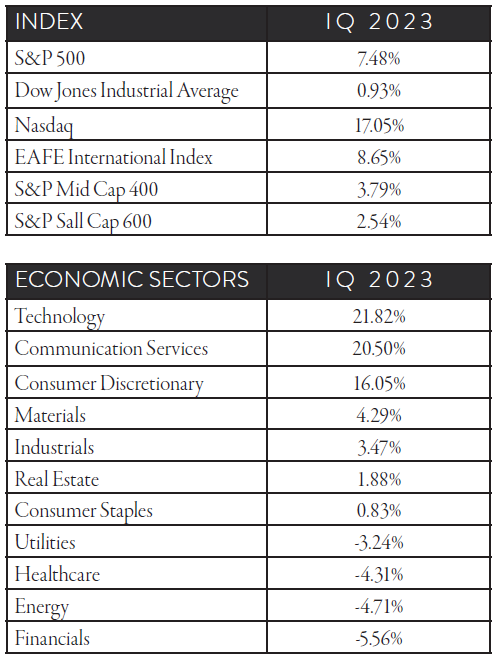

SECTOR SPECIFICS

Technology, communication services and consumer discretion all showed stellar returns in the first three months of 2023. The other

eight sectors added very little to the 7.48% return for the S&P 500. This divergence in returns shows up dramatically with the difference in performance between the Nasdaq and the Dow Jones Industrial Average. Those three positive sectors were the very same sectors that were punished the most in 2022; showing returns of -28.2%, -39.9% and -37.0%, respectively, for 2022. The realization that the Fed may finally be at the end of raising interest rates provided for a relief rally in the sectors most affected by higher interest rates.

As mentioned, the banking stocks pulled the financial sector down for the quarter. The slower than expected reopening of China from COVID and the rising risk of recession weighed on the price of oil, slowing the impressive rebound in the energy sector. After the 65% return in 2022 for energy stocks, a slight

pullback should not be too surprising.

LOOKING AHEAD

At the end of a crazy quarter, we are still left with the same unanswered question: When will the Fed stop raising rates? It certainly feels that after two more rate hikes in the 1st quarter, and a tightening banking sector, this new quarter may finally provide the end to the rate hikes. If that does happen, will the relief rally of

2023 continue?

The first hurdle will be the continued return to normalcy of the that would cause interest rate cuts from the Fed are

- inflation coming down dramatically in the next several months or

- the economy falling into a recession and the labor market weakening considerably.

With wages across the economy rising around 4% a year, it is difficult to envision inflation falling all the way to the 2% target. With the strength of the consumer, it is also hard to see a deep recession for the U.S. economy.

If inflation gets stuck around 4%, and the labor market remains strong, there is a good chance we won’t see those expected rate cuts from the Fed during the last six

months of 2023.

If that is the case, those same three sectors (technology, communication services and consumer discretion) that performed well in 1st quarter may see those early tailwinds of 2023 turn in to headwinds the second half of the year.

The Oakworth Investment Committee was hopeful that we would find some stability in 2023. If the first three months are any indication, the “fasten seat belt” signs for stock investors may remain on for a little while longer.

_______

This content is part of our quarterly outlook and overview. For more of our perspective on this quarter’s economy, inflation, bonds, equities and allocation, read our entire 1st Quarter 2023 Macro & Market Perspectives.