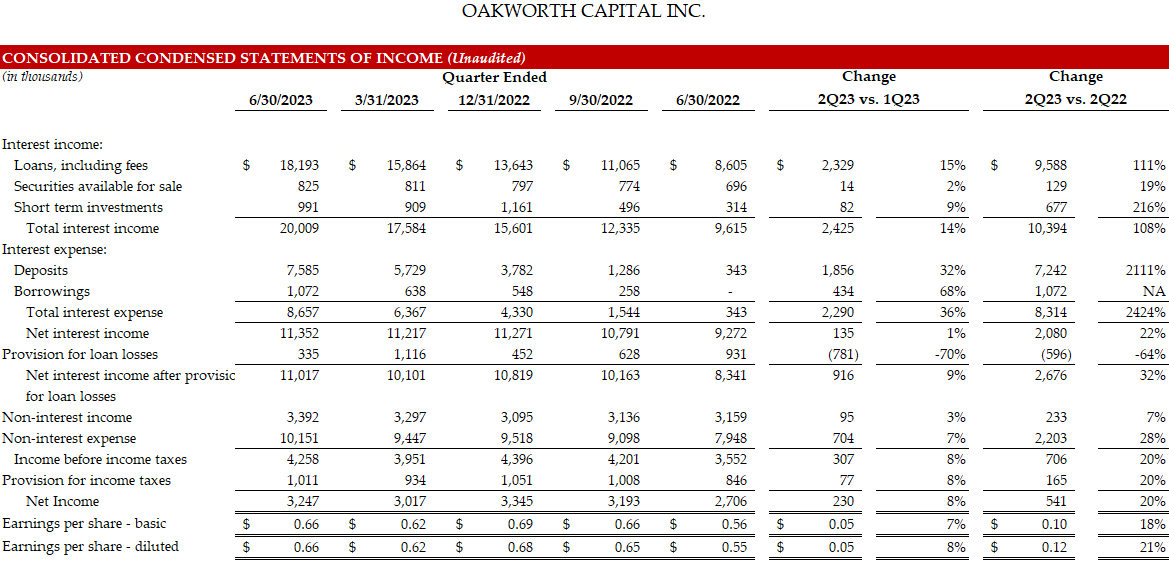

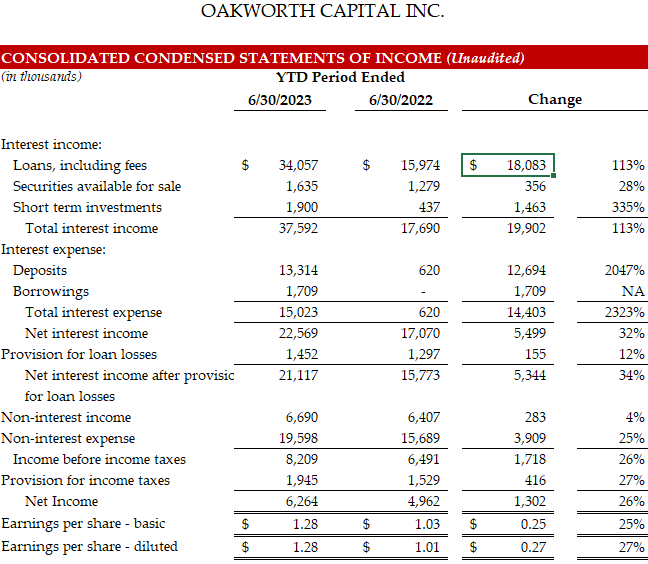

Oakworth Capital Inc. (OTCQX: OAKC) reported 27% higher diluted earnings per share and 26% higher earnings year-to-date June 30, 2023 compared to the same period of 2022. Pre-tax, pre-provision income increased 24% in the same period. First half 2023 return on average equity was 11.6% and return on average assets was 1.0%.

Oakworth’s Chairman and CEO Scott Reed stated,

“Oakworth continues to execute on our plan to bring a unique approach to financial services in all of our markets as demonstrated by balanced growth across our core disciplines.

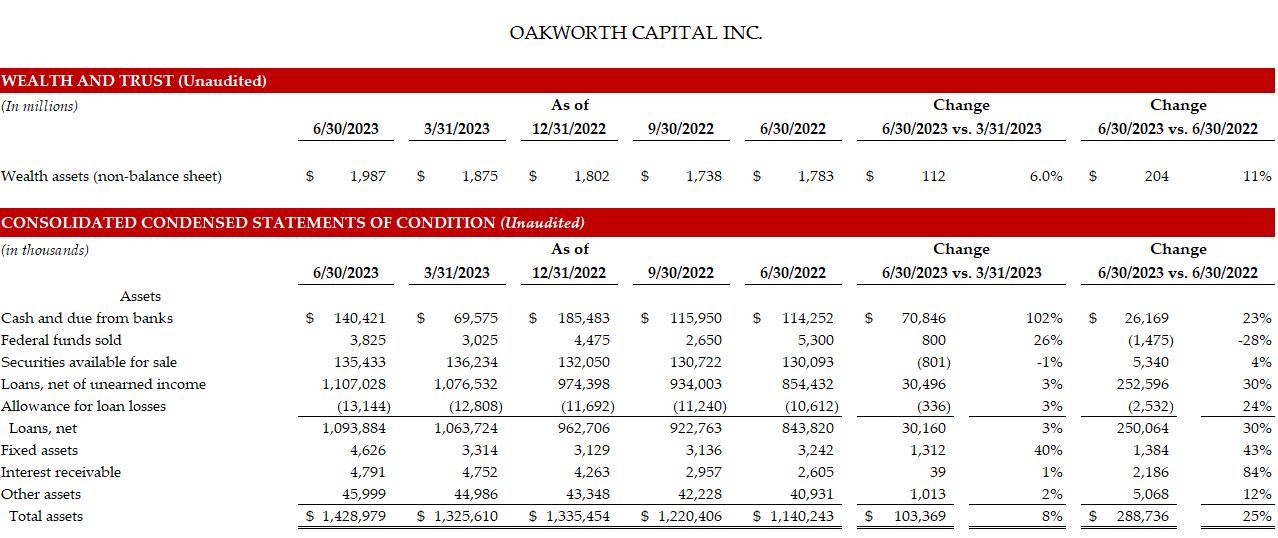

“The growth in deposits is notable given the industry turmoil in the first half of 2023 related to the failure of three large regional banks. This deposit growth is tangible evidence that Oakworth is viewed as a stable and safe institution for its clients. I am also pleased with the return of our wealth book to its previous record level of nearly $2 billion in assets which is the result of our team’s ability to add nearly $70 million in new wealth assets along with some amount of market value recovery.”

Mr. Reed continued, “In addition to maintaining a 96 Net Promoter Score over the past 12 months, we have been preparing for a successful opening of our Central Carolinas office in the third quarter. We continue to attract associates who embody our core values and who will provide the consistent, high level of service that has become synonymous with Oakworth. The reception Oakworth has experienced to date is exciting, and we look forward to executing our business model in another dynamic market.”

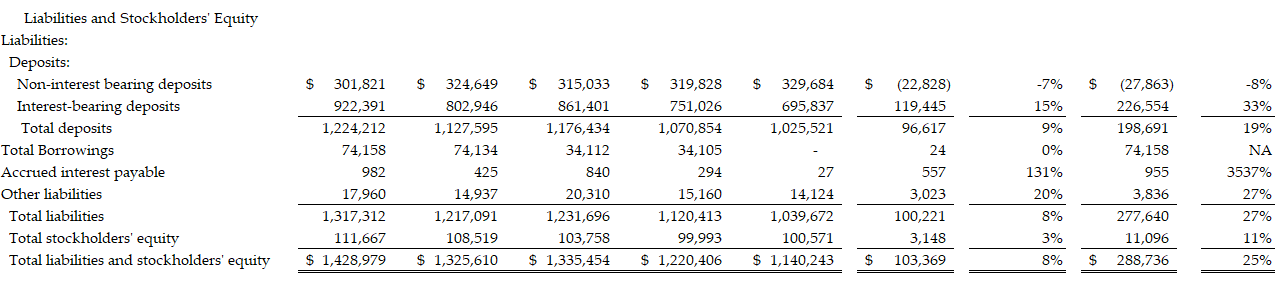

Net income for the quarter was $3.2 million with total revenue of $14.7 million. Quarterly earnings per share were $0.66 on a diluted basis, up from $0.55 one year earlier and $0.62 in the prior quarter. Net interest income increased 22% compared to second quarter 2022 and 1% linked-quarter. The second quarter 2023 net interest margin was 3.45% compared to 3.31% one year ago and 3.64% in the prior quarter. The margin contraction in the most recent quarter is attributed to faster deposit growth, higher overall deposit interest rates, and moderated loan growth. Wealth fees were steady both linked quarter and compared to second quarter 2022. Wealth assets were $1.99 billion at June 30, 2023.

Oakworth’s credit quality remains pristine with $0 charge-offs, $0 non-performing assets and $0 90-day past due loans as of and for the quarter ended June 30, 2023.

Oakworth’s capital position remains strong. At June 30, 2023, Tier 1 Capital was 10.2%, the Total Capital Ratio was 11.2% and the Leverage Ratio was 9.6%.

About Oakworth Capital Inc. and Oakworth Capital Bank

Oakworth Capital, Inc. operates a the bank holding company for Oakworth Capital Bank (Oakworth) (OTCQX: OAKC). Oakworth was founded in 2008 and operates three offices in the Southeast, including its headquarters in Birmingham, Alabama and plans to open a fourth office in 2023. Oakworth provides commercial and private banking, wealth management and advisory services to clients across the United States.

Oakworth has been named the #1 “Best Bank to Work For” for the past five years in a row (2018-2022) by American Banker. Additionally, Oakworth has earned a Net Promoter Score (NPS) of 96 out of 100 (June 2022 to June 2023) and has a client retention rate of 95% in 2022. As of June 30, 2023, Oakworth had $1.4 billion in total assets, $1.1 billion in gross loans, $1.2 billion in deposits and $2.0 billion in wealth and trust assets under management. For more information, visit www.oakworth.com.