After a feverish end to 2023 in both the economy and the markets, the question on everyone’s minds was what they would do for an encore to start 2024. Despite the somewhat softer economic data, investors apparently didn’t get the news, at least not stock investors, who showed continued optimism. Unfortunately for bond buyers, 2024 started off as a repeat of 2023. Lots of red ink.

The reason behind this pattern lies in the markets’ belief that the Federal Reserve will come to the rescue for whatever ails us, and will cut the overnight lending rate. Doing so will make money less expensive in the economy, which should lead to greater lending and money supply growth. Historically, this has always fueled economic activity.

As I type this at the end of the 1st quarter of 2024, investors believe the Fed will potentially cut the overnight rate by 0.75%, or 75 basis points, within this year. The hope is that it will be even more substantial than that. However, for such an aggressive monetary easing to take place, there will have to be a more pronounced decrease in the rate of inflation, and the labor markets will have to cool more than they already have.

Interestingly, there is a noticeable disconnect between the official economic data and the public’s perception of reality. The reason is this: the price of essentials appears to be increasing at a higher rate than the Consumer Price Index (CPI). Further, while the official employment data remains robust, the devil is in the details and things aren’t as red-hot as they were 12 months ago.

Regardless, investors drove the S&P 500 higher by 10.55% during the 1st quarter, riding heavily on the back of anything involving artificial intelligence (AI). To that end, the 800-pound gorilla in the AI world, Nvidia, was up over 82% during the first three months of the year. This on top of the company’s mind-boggling 239% return in 2023.

But how much longer can the good times roll?

The probable-case scenario is that the remainder of the year will not be as easy as the 1st quarter. Unless the Federal Reserve opts for more aggressive rate cuts than anyone currently believes, the markets, already believed to be fully valued, will need a sharp increase in corporate earnings to keep the rally going at this pace. While that isn’t likely, weirder things have happened, but the next two quarters could be a little choppy.

As such, the 1st quarter of 2024 was perhaps the calm before the storm as campaign season unfolds. This proves to be very contentious and could play upon investors’ psyches. Even so, the markets have historically tended to do well in presidential election years, and lower rates are ordinarily a good way to soothe the nerves.

In the end, it was a great start to the year in the stock markets. The economy cooled a little but didn’t go cold. The Fed is on tap for a few rate cuts this year, and the markets have historically performed well when 1600 Pennsylvania Avenue is up for grabs.

Thank you for your continued support,

John Norris

Chief Economist

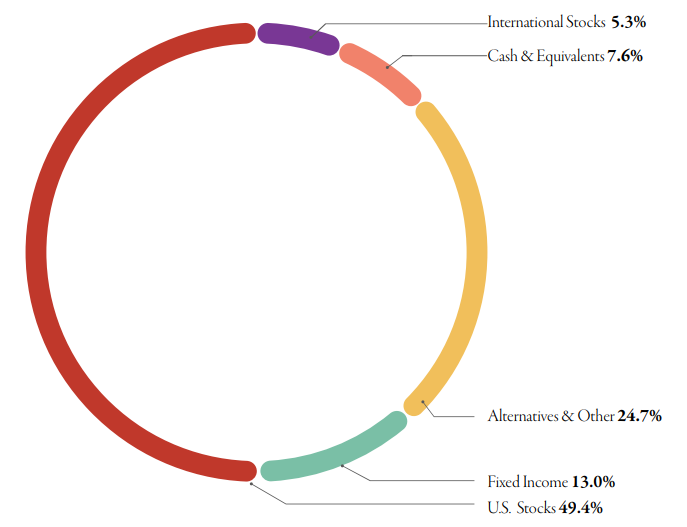

Our Investment Committee distributes information on a regular basis to better inform our clients about pending investment decisions, the current state of the economy and our forecasts for the economy and financial markets. Oakworth Capital currently advises on approximately $1.9 billion in client assets. The allocation breakdown is in the chart below.

The opinions expressed within this report are those of the Investment Committee as of the date published. They are subject to change without notice, and do not necessarily reflect the views of Oakworth Capital Bank, its directors, shareholders or employees.

This content is part of our quarterly outlook and overview. For more of our view on this quarter’s economic overview, inflation, bonds, equities and allocation read our entire Annual 2023 Macro & Market Perspectives.