The first quarter of 2023’s epic finale in the world of financial markets and institutions included bank failures and plenty of volatility. This, however, was quickly lulled back to sleep in the second quarter, as a reversion to the mean (and welcomed arrival of stability in most markets), reared its beautiful head.

While that may sound too good to be true, in the reality of things, the second quarter was substantially phenomenal. The woes of a potential banking crisis were put to bed as the Federal Reserve, per usual, stepped in and essentially backstopped all bank deposits, even those in excess of the proverbial $250,000 FDIC limit. Because of this, the previous (and precipitous) staircase jumps in bond market volatility quickly subsided.

This is particularly visible in the Bank of America MOVE Index, which essentially measures the amount of underlying volatility within the bond asset class. As seen below, the MOVE Index (along with the VIX Index, a measure of volatility in stocks) quickly calmed in the second quarter as the March banking crisis subsided.

BofA MOVE INDEX US VIX VOTALITY INDEX

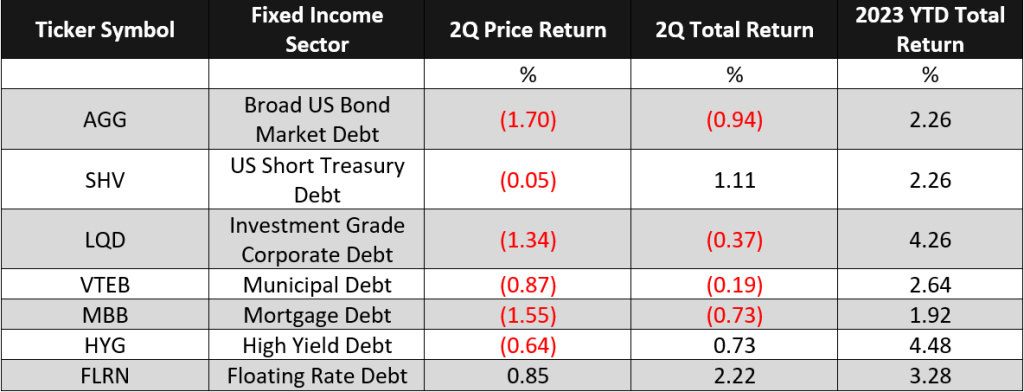

During the 2nd quarter of 2023, the bond market experienced several shifts driven by a host of factors.

- Monetary policy’s decisions remained the absolute focal point for fixed income, as the Central Bank meticulously navigated the delicate balance between supporting economy recovery and growth, while also addressing continued inflation concerns.

- In response to still-rising inflation (though at a decreasing rate of increases), the Fed signaled tighter monetary policy through its interest rate hikes. As a result, bond yields mostly trended upwards, with investors adjusting their strategies across the board in anticipation of the still-changing rate environment, searching for pockets of higher-yielding debt products, or adjusting their portfolio’s duration(s) to manage inherent interest rate risks.

- Key economic data points such as GDP, the jobs number, and inflation (CPI or PCE, take your pick) deeply influenced bond market sentiment. Ultimately, the bond market saw elevated volatility compared to the historical average, though a decrease from the first quarter of the year.

Still, the bond market as a whole experienced much of what has been seen over the course of the previous 18 months.

So long as the Federal Reserve continues to increase their benchmark overnight lending target, investors will demand a higher coupon, thus making the existing bonds with their now-lower rates less attractive.

Therefore, as the Central Bank raises interest rates, bond prices faced downward pressure. Yields move inversely to prices, so when bond prices decline, yields increase – investors want a higher compensation (re: yield). As a consequence of this, we also saw the yields on existing bonds rise to mimic that of the increase in coupon rates offered by new bonds.

Not all types of bonds react the same during a tightening cycle. The impact of rate hikes varies dependent upon bonds’ varying maturities and credit qualities – which, in turn, influence their sensitivity to interest rate changes.

GOVERNMENT BONDS

Government bonds, or U.S. treasury bonds, saw continued upward movement on yields, largely driven by worries around a much-feared U.S. debt ceiling debate in Washington. As with most things Washington, the two highly divisive houses of Congress allowed for numerous talking heads to splatter their opinions of the economy, the Central Bank, and the nation’s deficit on mainstream news sources. This, in turn, weakened the public’s opinion of Washington further, thus causing a frenzy in the bond market as investors questioned the truthfulness behind the treasury’s alleged ‘risk-free rate of return’.

In late May, as the default appeared as imminent to some, there were numerous days where the 1-month treasury bill actually yielded significantly more than the Federal Reserve’s overnight lending target – highlighting investors’ fear around a government default, and the treasury’s inability to ‘make good’ on its own debts.

In the end, history did repeat itself – as the movement on ‘risk-free’ assets proved there is always an inherent risk to any kind of investment – but limiting that risk to that of the investor’s appetite… is most important.

THE FEDERAL RESERVE

In June, the Federal Reserve’s Open Market Committee (FOMC) met and opted to pause, or perhaps ‘skip’, on another rate increase. The March banking crisis combined with confusing, slowing economic data pushed off the voting members to favor an additional 25 (or 50) basis point hike in June; however, most of the members now view a rate increase in July as inevitable – with the potential for an additional even thereafter. At the end of the quarter, the CME Group’s FedWatch tool priced a more-than 88.0% chance of another 25 basis rate increase at the July 26th meeting. On top of that, the market has even begun to price the chance of an additional 25 basis points between July and the end of the year. This is largely driven by the economy’s resilience, despite some slowing (particularly in the manufacturing and services sectors), as well as inflation remaining stubbornly high. As the summer progresses to the fall, the year-over-year nominal values for the Consumer Price Index, or CPI, will begin to increase – proving it more difficult to increase at a decreasing rate from month-to-month.

With this said, the Federal Reserve indubitably remains closer to the end of its tightening cycle relative to its beginning.

As the Central Bank nears the light at the end of its tunnel, fixed income should elevate in its relative attractiveness as an asset class.

Lower, and/or declining, interest rates tend to boost bond prices, leading to potential capital appreciation. This is simply the inverse relationship shared between bond price(s) and bond yield(s).

Because of this, a sharp deviation from what was seen the first half of 2023 could be anticipated in the back half (as well as the start of 2024) as investors pull capital away from cash and allocate into fixed income.

The exact timing of this; however, remains yet to be seen – as the Fed’s chair, Jerome Powell, continually reiterates the bank’s dedication to remaining data-dependent, hellbent on not throwing the economy into some form of deep recession, or ‘hard landing’.

In the end, the second quarter of 2023 shared several key similarities with that of the prior six. The bond market reacted negatively, or favorably, with each signal from the Central Bank regarding the direction of future rate decisions, with volatility remaining prevalent until fewer ‘unknowns’ are left in the underlying economic data.

For more from our Investment Committee in our 1st Quarter 2023 Macro & Market Perspectives, click the image below.

The opinions expressed within this report are those of the Investment Committee as of the date published. They are subject to change without notice, and do not necessarily reflect the views of Oakworth Capital Bank, its directors, shareholders or employees.