If you only had one word to best explain the 1st quarter of 2025, it would probably either be exhausting or confusing. Perhaps it would be a combination of the two. Exfusing has a certain ring to it. Who knows? Exfuse could be the verb, and exfusion might work as a noun.

The only certainty after first quarter is that it is finally over.

Unfortunately, investors usually tend to prefer certainty over political upheaval. While there has always been money to be made in volatility, it remains to be seen just how much there is under upturned apple carts. As such, after a solid start to the year in January, the markets posted a lot of red ink during February and March.

After two consecutive calendar years of relatively easy money, the threats of global tariffs and the ease with which DOGE was able to uncover potential cost savings had a negative impact on both consumer and business sentiment, especially the former. However, it remains to be seen just how much of an impact this loss of confidence had on actual economic activity.

The initial read suggests the U.S. economy likely contracted during the 1st quarter. While consumer spending slowed, much of the decline stems from a significant deterioration in our trade deficit, as businesses rushed to stock up on their imports prior to any tariffs taking effect. Fortunately, this type of short-term decline on the Gross Domestic Product (GDP) equation tends to self-correct when imports decrease over subsequent quarters.

But will the economy continue to slow moving forward?

Much of that will depend on the labor markets and inflation data. If the economy keeps creating jobs at the same pace it has over the past three years, it is unlikely that inflation will fall rapidly enough for the Federal Reserve to meaningfully cut the overnight rate. This will keep the cost of capital relatively high, which will put somewhat of a ceiling on overall output.

The inverse is also true. Inflation will start to moderate more substantially if job growth starts to cool. At this time, this is the most probable-case scenario, which means the Federal Reserve will likely resume cutting rates in the not-so-distant future. This should help to alleviate a more significant economic slowdown.

In the end, again, it was an exfusing quarter. What is going to happen with tariffs? DOGE? The Federal Reserve? Job creation? Inflation? GDP? The markets?

Yeah, I think it is safe to say most people are happy the 1st quarter of 2025 is over. That much is certain.

Finally.

Thank you for your continued support.

John Norris

Chief Economist & Chief Investment Officer

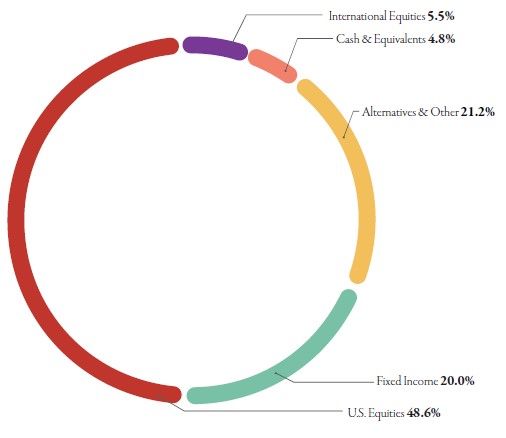

Our Investment Committee distributes information on a regular basis to better inform our clients about pending investment decisions, the current state of the economy and our forecasts for the economy and financial markets. Oakworth Capital currently advises on approximately $2.2 billion in client assets. The allocation breakdown is in the chart below.

This content is part of our quarterly outlook and overview. For more of our view on this quarter’s economic overview, inflation, bonds, equities and allocation read latest issue of Macro & Market Perspectives.

The opinions expressed within this report are those of the Investment Committee as of the date published. They are subject to change without notice, and do not necessarily reflect the views of Oakworth Capital Bank, its directors, shareholders or associates.