As the global economy reopened from the COVID shutdown, many planned their bucket list trip. My wife and I were no different. We planned our trip to Italy and enjoyed looking up restaurants to try and museums to visit. As the trip inched closer, the anticipation started to build . When we were only a week or two away from the trip, everything was ready.

That was probably the best part of the trip .

Please don’t be confused – we had an amazing time on the trip. We went to every museum and restaurant we wanted to, but it was crowded, hot and expensive. The problem? The trip had al most no chance of living up to our expectations. In talking with friends, most agree that the anticipation and excitement before going on the actual vacation is sometimes the best part.

THE IMPACT OF AI

How does this translate to the current equity markets? I believe that the economy is pricing in the excitement and anticipation of the Artificial Intelligence (or AI) impact on the economy. This AI “vacation” the economy is about to embark on is very close to starting, and the market can sense it.

The last such “trip” the stock market had at this level of anticipation was with the advance of the internet in the mid- to late 1990s. Like today, the impact across every sector of the economy was unmistakably dramatic. Some analysts accurately predicted how different companies would benefit from the coming tidal wave, while others missed the mark. That is most likely going to be the same result with analysts’ expectations for the AI winners .

We are still some time away from figuring out the true impact of AI on different sectors of the economy. AI should help with the shortage of skilled labor and boost corporate profit margins, which should in turn improve corporate earnings. What we do not know is by how much. As for the potential downside? We must consider how many highly skilled jobs will no longer be needed in the next five to ten years, and whether or not those workers will find that their skills are no longer needed or are deemed less valuable than they were before AI.

We may still be a few years from having answers to these important questions, but that doesn’t mean the market can’t start pricing in the anticipated financial effect. The gap between the anticipated financial effect and the actual effect is where we could see some pretty wild pricing adjustments (both higher and lower) in the quarters, and years, ahead.

Like in the late 1990s, some stocks that surged dramatically and seemed expensive were still undervalued compared to their actual future earnings. Microsoft and Oracle, for example, were expected to be winners back in the mid-1990s and turned out to be just that.

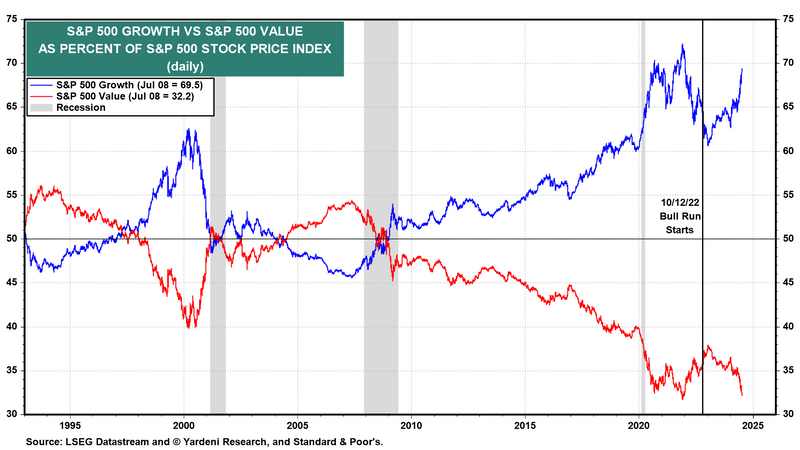

TRENDS IN S&P GROWTH VS. S&P VALUE

With equal conviction, investments poured into stocks such as Sun Microsystems and JDS Uniphase. Those calls turned out to be not so great. Even Cisco Systems, which was the second largest stock in 1999 (behind General Electric), is still trading 40% below its peak from 24 years ago.

Similarly, there is a good chance some of the most important companies in the AI sector don’t even exist yet. For example, Google, Facebook (Meta) and Amazon ended up as some of the biggest winners from the growth of the internet, but only Amazon was publicly traded in 1995 (and they only sold books at the time). Google went public in 2004 and Facebook in 2012. If your high school or college student is working on some newfangled AI startup in your garage, I would advise you to let them finish it. The comparison to the late 1990s is not perfect, but it’s the best we have to go on. The massive overweight to growth stocks as compared to value stocks is even more extreme today than it was in the early 2000s.

MARKET TURNAROUND?

At some point, we should see a reversal of this trend, with the renaissance of the value sectors of the stock market. The run on the growth sectors of the market from the Great Recession of 2008 was fueled, in part, by extremely low interest rates. As we move forward, interest rates over the next decade will most likely be much higher, on average, than rates we experienced from 2008 to 2021.

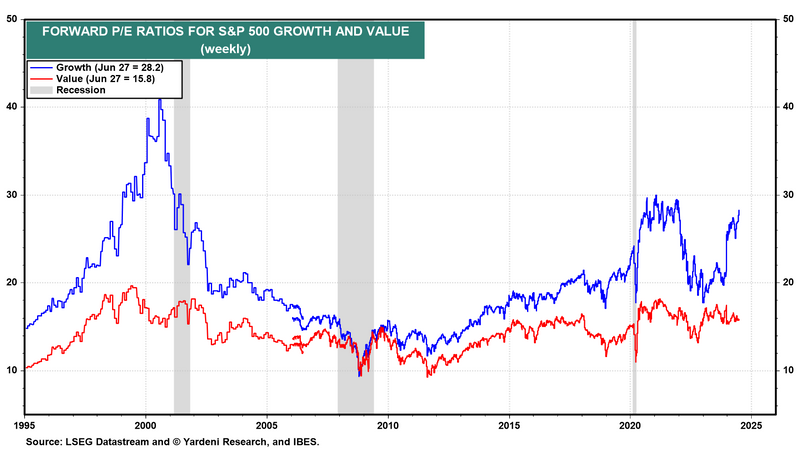

What should relieve investors is that valuations of both growth and value stocks today are much lower than at the peak of the 2000 tech bubble. Currently, the P/ E ratio on growth stocks is 28.3x, as compared to the 42x earnings in March 2000. While our current situation is similar to the late 1990s, it is definitely not the same.

FORWARD P/E RATIOS FOR S&P 500

2ND QUARTER RESULTS

At the start of 2nd quarter, the stock market was hoping for falling inflation data and strong 1st quarter corporate earnings. For the most part, it got both. First quarter corporate earnings came in 6% above 1st quarter of 2023. Even more importantly, earnings expectations for the remainder of the year did not move down.

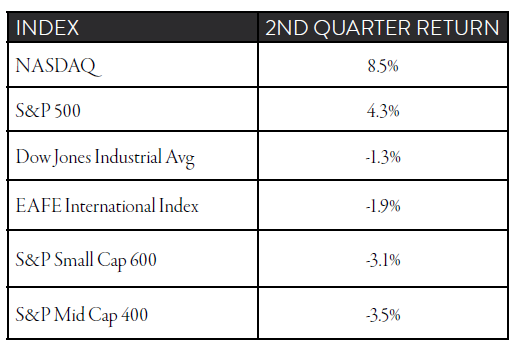

In the 2nd quarter 2024, the stock market had a breadth problem.

- The equal weighted S&P 500, or the average return for stocks that are included in the S&P 500, was -2.3% for the quarter.

- The S&P 500, which is a market weighted index, was up just over 4% for the quarter.

- Just a handful of very large stocks (NVIDIA, Microsoft, Apple, Alphabet and Amazon) provided almost all the return for the S&P 500 in the quarter.

- Those same stocks make up an even bigger percentage of the NASDAQ Composite index, and that index was up 8.5% for the past three months.

All other major equity index returns were negative for the quarter. These include the Dow Jones Industrial Average, mid cap, small cap and the EAFE international index, which all struggled.

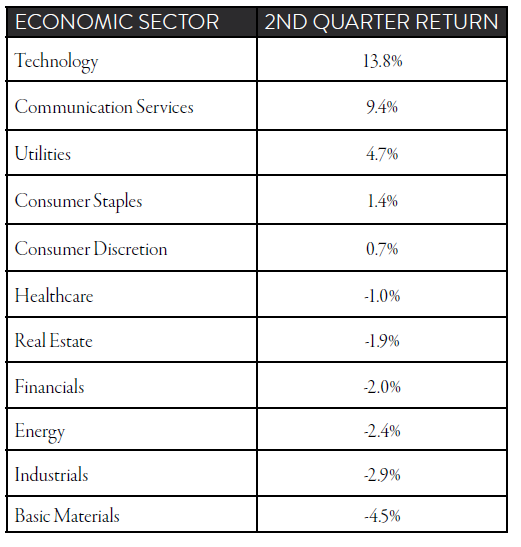

Looking at the returns of the economic sectors of the equity markets paints a clearer picture of where the returns were this past quarter.

The technology sector, which includes NVIDIA, Microsoft and Apple, along with the communication services sector, led by Google’s parent company Alphabet, showed strong 2nd quarter performance. Surprisingly, the utility sector also performed well. This defensive sector has some tailwind behind it, as all of these new AI computers require quite a bit of electricity. Together with the push for more electric vehicles and the cryptocurrency mining, the demand for electricity should continue to climb. The utility sector is also very interest rate sensitive, and the hope of rate cuts in the next several quarters should further support its performance.

Note: Six of the 11 economic sectors that comprise the S&P 500 posted a negative return in the same quarter where the overall index showed a gain of 4.3%

This narrow market leadership, which was also the case for most of 2023, is back. Smaller stocks, for the most part, do not have the same financial flexibility as the mega-cap stocks, and high interest rates have placed additional pressure on them.

NVIDIA

The big story of the 2nd quarter is the same as the first quarter: NVIDIA

- After gaining just over $1 trillion of value in the 1st quarter of the year, it added another $1 trillion in value this past quarter.

- In the 34 trading days between May 1 and June 18 alone, NVIDLA’s market cap increased by $1.3 That is $38.2 billion of additional market value per trading day over that screech.

- NVIDIA’s competitive advantage is evident in its gross profit margin, which has increased from 56% in April 2023 to its current level of 75%, while quarterly revenue grew from $7.2 billion a year ago to $26 billion this past quarter.

LOOKING FORWARD

The 2nd quarter provided enough economic cooling to allow lower inflation numbers. We will find out as we move into the 2Q24 earnings season whether that economic slowing will lead to lower-than-expected corporate profits. The market is also optimistic that we will have our first interest rate cut from the Federal Reserve on September 18. Continued favorable inflation data will dictate whether this is possible.

By the end of the 3rd quarter, the race for the White House will be in full swing, and we don’t know what to expect politically over the next several months, except maybe continued chaos.

When push comes to shove, we still have a relatively strong consumer, with low unemployment rates and rising wages. Outside of a handful of growth stocks, equity valuations are not at extreme levels.

When it comes down to index returns, those top five growth companies that account for more than 25% of the S&P 500 will most likely dictate the direction of the overall market. In the 2nd quarter, that was a very good thing. Let’s hope the other 495 stocks in the S&P 500 can start to pull their weight, too.

Can NVIDIA’s market value continue to rise? The short answer is yes, but with a $3 trillion valuation, we are getting into some rarified air. As investors prepare for this trip into the AI future, this single stock seems to be carrying the most hope and optimism. Let’s hope this looming “AI vacation” lives up to the hype!

This content is part of our quarterly outlook and overview. For more of our view on this quarter’s economic overview, inflation, bonds, equities and allocations, read the latest issue of Macro & Market Perspectives.

The opinions expressed within this report are those of the Investment Committee as of the date published. They are subject to change without notice, and do not necessarily reflect the views of Oakworth Capital Bank, its directors, shareholders or employees.