Financial Highlights

42% increase in core net income* **

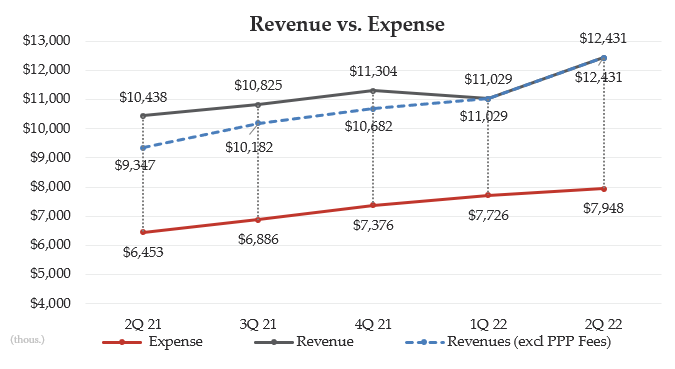

31% increase in core revenue

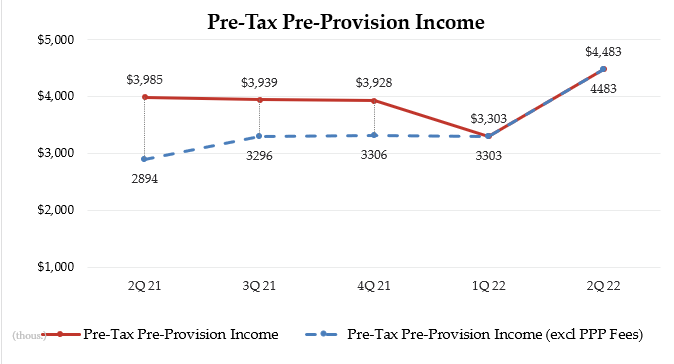

53% increase in pre-tax, pre-provision income

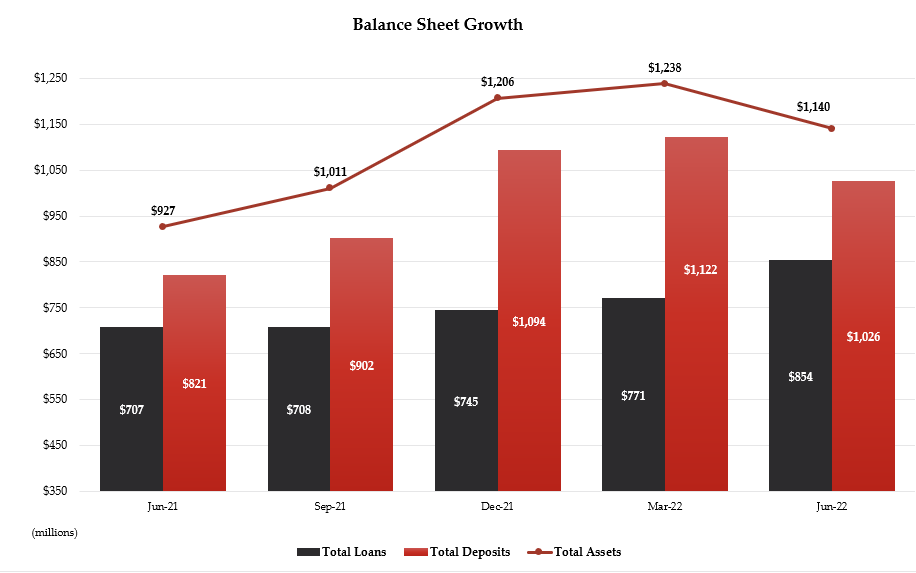

23% growth in total assets to $1.1 billion**

28% year-over-year core loan growth (excluding PPP balances)

25% year-over-year deposit growth

Wealth assets of $1.78 Billion, up 1%**

Wealth fees up 22% year-over-year

$127 million in new wealth assets in the first half, offset by declining market values

Core earnings per share* (diluted) of $1.01 vs. $0.72 year-over-year

Book value per share of $20.87, slightly lower than $20.93 at June 30, 2021

Impacted by $10MM change in “mark to market” adjustment to the securities portfolio, or $1.70/share

$0 net charge-offs, NPAs and Past Due +90 days

*Non-recurring items include reversal of $250,000 in provision for loan losses associated with the COVID-19 pandemic in first quarter 2021 and $2,083,000 in PPP-related revenue in the first half of 2021

**For the year-to-date period ended 6.30.2022 compared to 6.30.2021

Letter to Shareholders

The first half of 2022 has brought with it a realization of our planned progress. Our entry into Middle Tennessee in January 2021 has been a resounding success to date. Our periodic investments to extend our brand across the southeast have proven to pay off in the form of increasing growth and profitability. We also continue to invest in existing markets by adding new client advisors, support associates and by investing in our brand recognition marketing efforts. We have built a predictable track record of making strategic investments, and then realizing the benefits of these investments in subsequent years. We have also been preparing for significant growth by investing in infrastructure to serve our increased scale and to maintain our exceptional track record of client and associate satisfaction. One such strategic investment has been to welcome summer interns each year. We welcomed seven summer interns across all three markets in early June and have benefitted from their contribution as they rotated through several areas of our bank. Importantly, we have recently hired former interns into permanent roles. This is truly a “win-win” scenario for Oakworth and our new associates because there is no better way to determine cultural fit than to have these individuals work with us for an extended period of time.

Something special is happening at Oakworth! Our long-term objective is to “Become An Iconic Brand” by redefining financial services. This is certainly a lofty goal but one whereby we are beginning to see tangible evidence of progress. We measure our client satisfaction through the Net Promoter Score (NPS) that we’ve discussed in this report before. Our NPS score is 96 out of 100 and we maintain a 99% client retention rate. We have been ranked the #1 “Best Bank to Work For” in the country for the fourth consecutive year and our associate retention rate is over 95% since inception. In the past year and a half, we have supported 99 charitable organizations and continue our commitment to contributing at a minimum of 1% of our net income to the communities that we serve. All of these objective measures suggest that we are making very good progress on achieving this ambitious goal.

We are also really encouraged by core financial performance in the first half of the year. Core performance simply extracts those items that are considered non-recurring and material to overall performance*. Core net income is 42% higher in the first half of 2022 compared to the same period of 2021. This bodes well for future shareholder value. While increasing interest rates have provided some meaningful lift to overall revenue, the majority of our improved revenue and resulting income is driven by growth in our overall business. Middle Tennessee has contributed to all aspects of our business, but we see its greatest impact to date in overall loans outstanding. Central Alabama and South AL have contributed balanced growth. Our investment portfolio has faced stiff headwinds like all other investment firms with the year-to-date decline in overall stock market valuations. In spite of tough overall market conditions, we have seen continued growth in new client investment accounts.

The current interest rate environment also impacted our equity via the unrealized “mark to market” loss on our securities portfolio. The impact of this negative adjustment to book value per share will likely continue this year; however, we have no expectation of realizing that loss in the securities portfolio.

Entering the back half of 2022, we should continue to benefit from rising rates. Our credit quality remains pristine and, while we see no immediate threats to credit quality, we are monitoring economic conditions and the potential impact on our clients. We are cautiously optimistic that we’ll see improvement in market values with respect to our wealth assets which also impacts wealth fees. Regardless, we are seeing great demand for our way of delivering financial services and we plan to continue to explore ways to identify and meet that demand. We remain excited about our future and are glad each of you is along for the ride with us!

In summary, Oakworth had a very positive first half of the year. We are seeing significant benefit from our most recent investment in Middle Tennessee and are making tangible progress on our goal of becoming an “Iconic Brand”. We also look forward to reporting on other exciting developments related to future growth and to getting the story of Oakworth to a broader audience. As always, we truly appreciate your continued support!

Sincerely,

Chairman and CEO

Quarterly Graphs