Your 401(k) can be a powerful tool for building a secure retirement, but to fully benefit, it’s important to understand how to optimize your contributions and investments. In this guide, we’ll cover several key strategies to help you make the most of your 401(k), ensuring that your retirement savings grow effectively and set you up for long-term financial success.

- Know your Benefits

The first step to maximizing your retirement benefits is to know exactly what you are entitled to. Some employers offer exceptional benefits, others are middling, and many do not provide benefits at all – it truly is a spectrum of different offerings and products that may be available. You must always consider the benefits package as being just as important as other factors (such as salary) when accepting a new job. In a recent survey from Gallup regarding the top things employees want in their next job, the top ranked was “increased salary or benefits,” as two-thirds of the survey participants ranked it as “very important” (Gallup). As salary is commonly the first thought about a job, benefits alone will likely impact 5-15% of the bottom line of a paycheck.

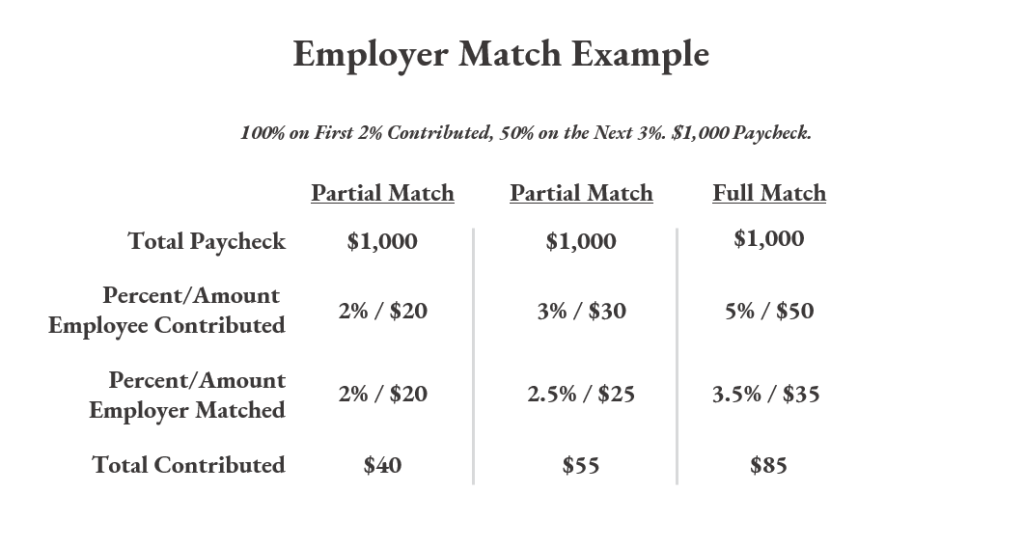

The most important aspect of understanding an employer-sponsored retirement account is knowing how much of an employer match is offered. Typically, an employer will offer a certain tier of match such as 100% on the first 2% and 50% on the next 3%. That’s a lot of percent signs and may be extremely confusing for a first-time investor, but there are many tools to help visualize and better understand the employer match, such as Bankrate’s 401k Retirement Calculator. It is important to ask as many questions as possible to your employer’s benefits coordinator or human resources department.

When determining the right amount to contribute to a 401(k), there is a common misconception that you should always maximize the amount that will be employer-matched. While I am a fan of always taking any free money, every financial situation is unique, and a budget can help lead you in the right direction of understanding the best amount to save. Ideally, overall savings of 10-14% of your gross income is a terrific benchmark to use, and even better if several of those percentage points are contributed by your employer.

Keep in mind : aim to contribute at least enough to get the full employer match – otherwise you are leaving money on the table!

- Understand the Contribution Limits

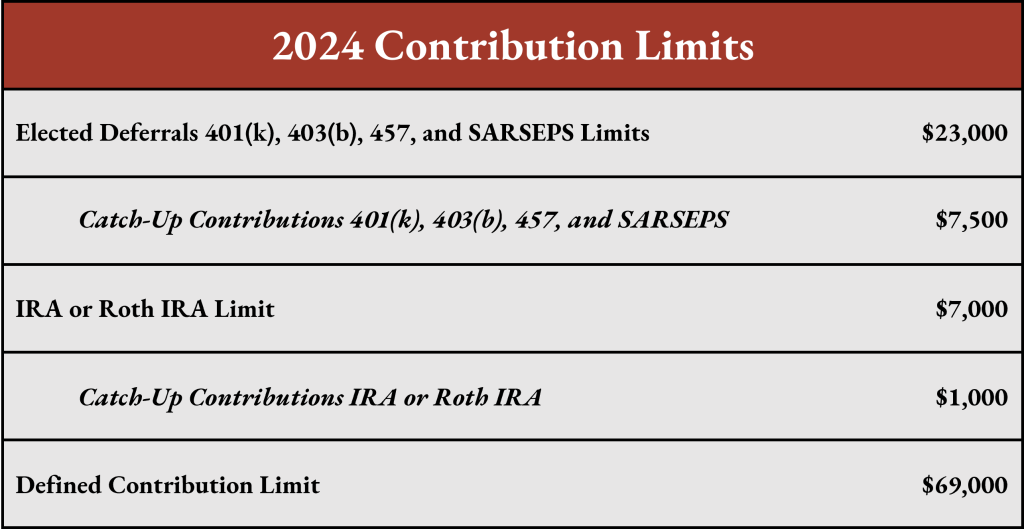

Like all great investment savings tools, there are several important caveats regarding the contribution amount for a 401(k). For 2024, an individual’s maximum 401(k) contribution is $23,000 per year. However, there is also a “catch-up contribution” of up to $7,500 per year for individuals over 50. Employers may still contribute after the $23,000 per year but are capped when the total hits $69,000 (or $76,500 for catch-up contributions).

3. Maximize your tax break

A 401(k) is a tax-deferred plan, where employees can contribute before-tax dollars. This not only lowers your overall take-home pay but your income taxes as well. The investments inside the 401(k) will grow tax-free, but of course, will be taxed on the back end. It is also important to understand this makes withdrawals on the back end even more important and preferable after retirement when your income is lowered. It also maximizes the damage of early withdrawals before age 59 ½, as another 10% penalty will be added on top of the taxes on the withdrawal. However, there are several ways to avoid the penalty if taken for an early “qualified” withdrawal, which includes exceptions like the birth of a child or qualified higher education expenses (the full list of exemptions can be found on the IRS website).

- Consistently Save and Let it Grow

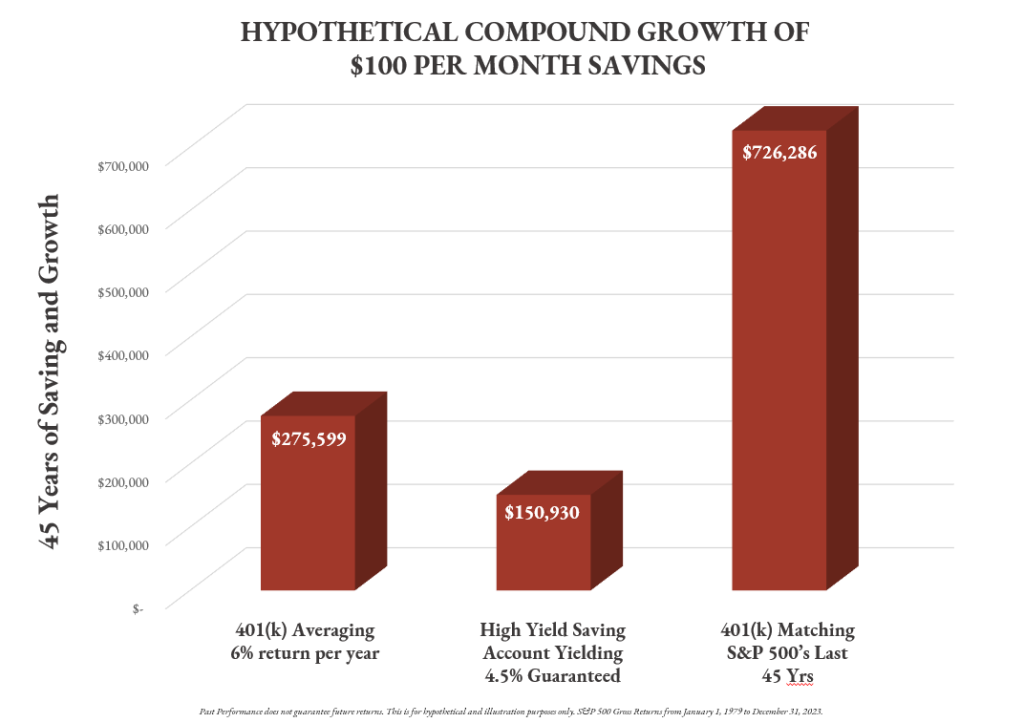

A 401(k) is often one of the first investment accounts many people ever get started with due to its growing popularity as a work-sponsored employee benefit. While saving into a 401(k) in your 20s may seem like stashing away money that you will never see again, you are doing yourself the ultimate favor by giving an exceptionally long runway to save and grow the account. By allowing investments to compound, you are allowing it to grow at an exponential rate that could far exceed any savings account or piggy bank. Even at a conservative 6% rate of return, a $100-a-month investment with a 0% match over 45 years would yield an account balance just north of $275,000.

A common question that I am frequently asked by first-time stock market investors is about avoiding the downside of the market. As a millennial whose generation can attribute core memories growing up to some of the most dramatic downswings in U.S. history, it is very common for people to favor less volatile products. It is human nature to fear the worst, especially regarding one of the most sensitive topics you face in life: what to do with your hard-earned money.

While past performance does not ensure future performance in any way, the U.S. stock market has a pretty darn good track record of growth, which even includes some of the harshest downswings. Since 2000, the S&P 500 index has returned just over 10% per year, which roughly doubles most of the best yields offered for savings accounts or short-term treasuries. Yes, there is always risk involved with any investment, but one must judge exactly what their tolerance is and weigh the potential return against it.

Now let’s talk about the downside. Since 2000, there have been 6 years that the S&P 500 has lost money and returned a negative for the year. It’s happened before and it will happen again, however, by staying invested through bull markets AND bear markets, the law of compounding has historically prevailed. Applying a long-term and well-diversified lens to the stock market has been the best strategy prepared to endure the highs and lows.

- Optimize your Allocation…Diversify – know the products offered

As mentioned in my last tip for optimizing your 401(k) potential, risk is something that should always be monitored throughout your financial journey. There are many safeguards and strategies to mitigate risk, but one of the most important is diversification. By diversifying the underlying assets in an investment account, you give yourself the best risk-return opportunity to defend against market volatility. By diversifying your portfolio, you simply are not keeping all the eggs in one basket. You may miss out on not being 100% into a stock that could 10x your entire portfolio, but more importantly, it also lowers the probability of the opposite happening.

This point is even more important for a 401(k) because most providers offer a limited bucket of investments to choose from. For example, a Fidelity 401(k) may offer anywhere from 10-20 different indexed funds to choose from that focus on a variety of different categories, styles, and market cap. By offering different index-tracked ETFs1, you are already gaining diversification from the start. The next step would be to ensure that your mix of these ETFs inside the 401(k) matches your risk profile the best. For choosing these assets, the best practice would be to consult with a financial professional.

- Understand the Fees

You can only net return so much depending on the cost of an asset. Depending on your employers plan, there can sometimes be a .5% to 2% management fee for your account. Many 401(k) providers don’t have direct management or broker fees, but there will almost always be an expense ratio cooked into the products offered to hold inside the 401(k).

The expense ratio is a basis point fee that is subtracted from the underlying return. Don’t worry, you will not be sent a bill for an expense ratio or even ever see it subtracted from your account, but your investment return will be marginally affected by it. For example, if there is an ETF that returned 10.00% gross for the year, but has a 20-basis point fee, the return you will see (as will everyone else) would be 9.80%. They are typically very low, but an investment professional should easily be able to compare all expense ratios for your investment options.

- Optimize your RMD

Last but certainly not least….the withdrawal phase! This is likely the most exciting part about your 401(k) but there are ever-evolving rules about the required minimum distribution. The required minimum distribution, frequently referred to as RMD, is the amount that must be withdrawn at a certain age. You can always consult with a financial professional to understand the current legislature regarding the RMD. It is also extremely important to know these rules for any retirement account that is inherited, as it could be costly if not followed properly.

Footnotes:

- ETFs or “exchange-traded funds” are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF, you get a bundle of assets you can buy and sell during market hours—potentially lowering your risk and exposure, while helping to diversify your portfolio.

This document is being provided for informational and educational purposes and is not meant to be taken as specific advice. Oakworth Capital Bank does not provide tax or legal advice. All decisions regarding the tax and/or legal implications of these strategies should be discussed with your tax and/or legal advisors before being implemented.