BIRMINGHAM, Ala. (May,1, 2023) — Oakworth Capital Inc. (OTCQX: OAKC) reported 35% higher diluted earnings per share and 34% higher earnings in first quarter 2023 than the same period of 2022. Pre-tax, pre-provision income increased 53%, taking into account 40% year-over-year loan growth.

Oakworth’s Chairman and CEO Scott Reed shared, “It has been an eventful quarter for our industry. Oakworth’s status as one of the safest institutions in the country has been top of mind for our clients. Our focus on a strong, well-capitalized balance sheet continues to provide confidence to our clients and has enabled us to execute on our growth objectives.”

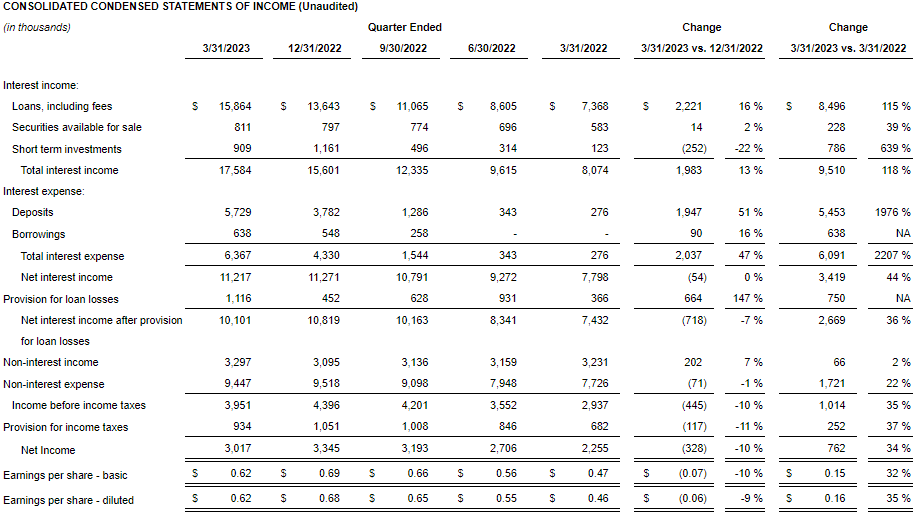

Financial highlights first quarter 2023 vs. first quarter 2022 are as follows:

- Net income of $3.0 million, up 34% from $2.3 million

- Total revenue of $14.5 million, up 32% from $11.0 million

- Diluted earnings per share of $0.62, up 35% from $0.47

- Net interest income up 44% year over year

- Net interest margin of 3.64% compared to 2.70% one year ago and 3.68% in fourth quarter 2022

- Reflects higher deposit costs, higher loan yields and a loan book growing faster than the deposit book

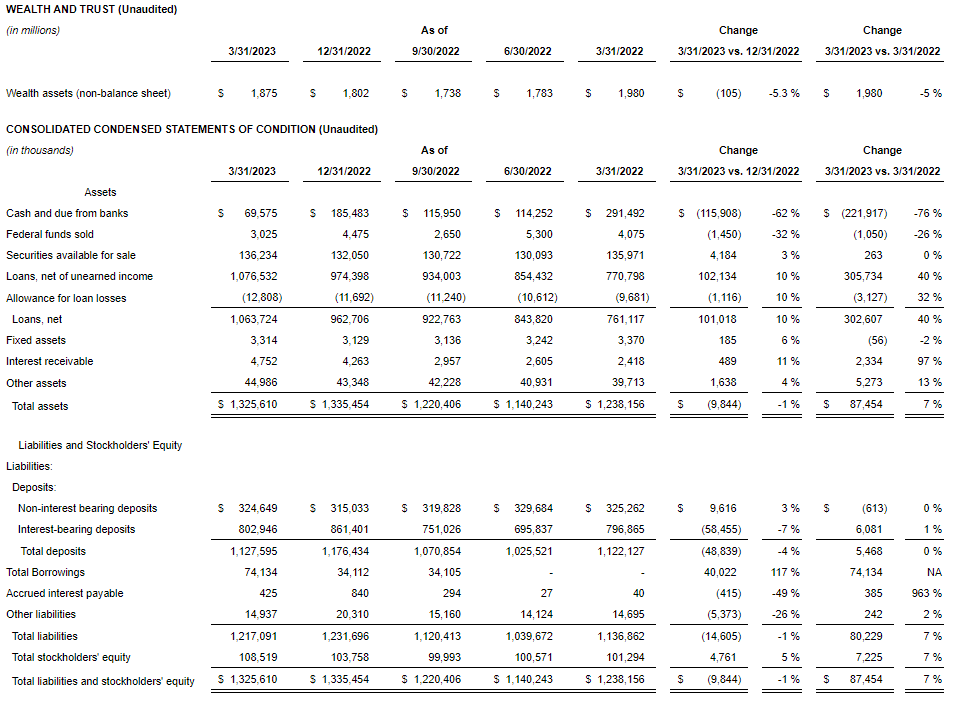

- Wealth assets of $1.9 billion, down 5% from $2.0 billion

- Wealth fees down 3% to $2.6 million

- Reflects market value changes offset by new accounts and additions to existing accounts

- Total assets of $1.3 billion, up 7% from $1.2 billion

- $1.1 billion in loans, up 40% from $771 million

- $1.1 billion in deposits in both periods

- Continued pristine credit quality with $0 charge-offs, $0 non-performing assets and $0 90-day past due loans in both periods

- Strong capital with a Tier 1 Capital ratio of 10.2%, Total Capital Ratio of 11.3% and Leverage Ratio of 9.8% as of March 31, 2023

Reed continued, “Our deposit book is diversified and entirely relationship based and was not significantly impacted by first quarter industry events. We remain pleased with how our balanced business model performs across market environments.”

# # #

About Oakworth Capital Inc. and Oakworth Capital Bank

Oakworth Capital Inc. operates as the bank holding company for Oakworth Capital Bank (Oakworth) (OTCQX: OAKC). Oakworth was founded in 2008 and operates three offices in the Southeast, including its headquarters in Birmingham, Alabama, and plans to open a fourth office in 2023. Oakworth provides commercial and private banking, wealth management and advisory services to clients across the United States.

Oakworth has been named the #1 “Best Bank to Work for” for the past five years in a row (2018-2022) by American Banker. Additionally, Oakworth has earned a Net Promoter Score (NPS) of 96 out of 100 (April 2022 through April 2023) and a client retention rate of 95% in 2022. As of March 31, 2023, Oakworth had $1.3 billion in total assets, $1.1 billion in gross loans, $1.1 billion in deposits and $1.9 billion in wealth and trust assets under management. For more information, visit www.oakworth.com.

OAKWORTH CAPITAL INC.

OAKWORTH CAPITAL INC.