Every presidential election cycle, we hear claims of it being “the most monumental election of all time.” I’d rate this statement as partially true. Every election is significant and impacts policies affecting Americans, but is the upcoming November 8, 2024, election truly the most monumental ever? Is every college football game “the most important game” of the season?

The most important election this country has seen is the one happening now.

CAUSATION VS. CORRELATION

During the Trump years of 2017-2020:

- Regulations were slashed.

- The tax code experienced a massive overhaul.

- And international trade tariffs were put into place to bring manufacturing back to the U.S.

Simply put, these policies led to economic growth.

U.S. equities performed very well under Trump, with bonds also outpacing long-term averages. Leading up to the COVID outbreak, the economy was buzzing. Then all “norms” flew out the window following a pandemic-induced economic shutdown. Fear shook global equity markets to their core – and it didn’t matter whom the president was. But as with other global catastrophes and worldwide disasters, we rebounded. The S&P posted an 18% return for the year, largely due to the Federal Reserve cutting the overnight lending rate to basically nothing. Monetary policy put forth by the Federal Open Market Committee (FOMC) lessened the cost of capital, regardless of who sat in office. Business activity surged, boosting companies’ enterprise valuations.

All of this led to a massive runup in equity prices until inflation, driven by supply chain shocks and an increase in M2 money supply, forced the FOMC to hike interest races back up to pre-Great Financial Crisis levels. These hikes began during the Biden administration and presented headwinds for U.S. equities. Regardless of who holds the presidency, rising interest rates will bring bond prices down and affect stock price valuations.

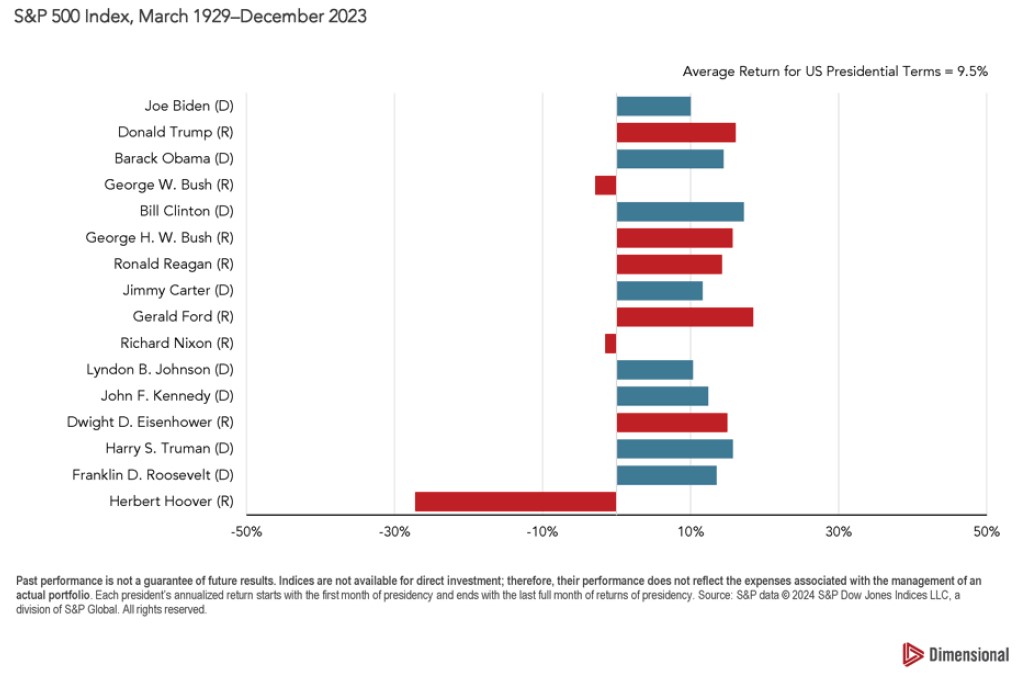

ANNUALIZED RETURNS DURING U.S. PRESIDENTIAL TERMS

There’s a common theme here in case you missed it: Right or left – it doesn’t matter who is in office – some things are within the scope of presidential powers and some are not. There are many variables and market forces that affect asset prices. The best strategy continues to be investing for the long term and ignoring short-term political changes, because the president cannot directly control the stock market… and that’s probably a good thing.

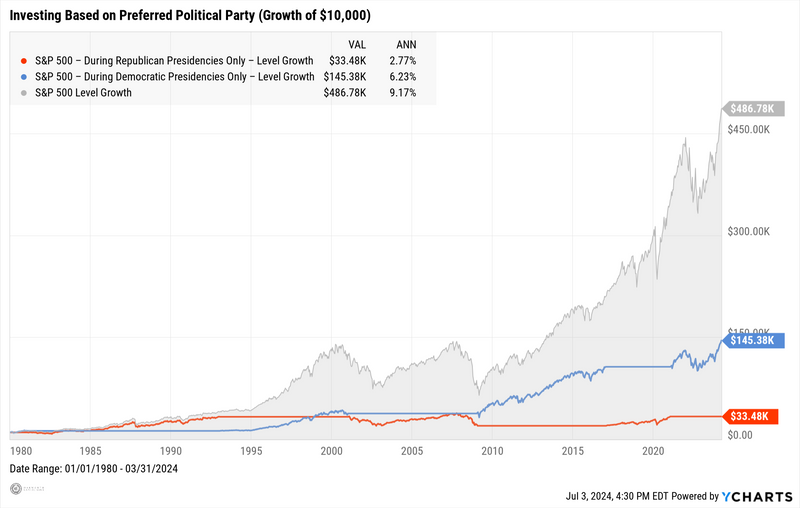

S&P PERFORMANCE DURING DEMOCRATIC AND REPUBLICAN PRESIDENCIES

We will likely see some volatility surrounding elections, as with any event carrying uncertainty; however, risks are priced into the market, solutions or workarounds are found and equity prices grind higher over the long term.

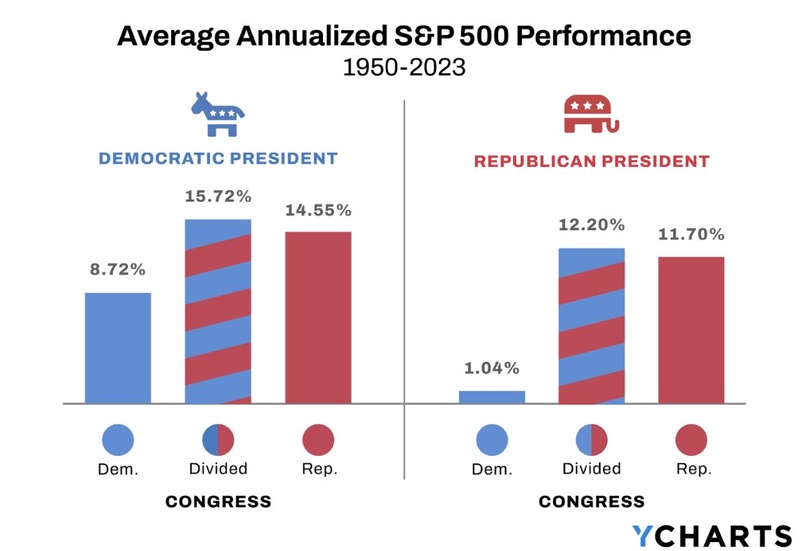

Looking at historical returns during the six political backdrops, the scenario yielding the strongest returns is a divided Congress, regardless of which party controls the White House. The stock market prefers political gridlock.

Equities perform the strongest when Congress has trouble passing new laws and businesses are left to, well, do business, without having to navigate political impulses. For the private sector, it is easier to forecast future earnings when external variables are removed.

WORLDWIDE POLITICAL SHIFTS

Leaning Right

Around 360 million Europeans went to the polls in early June, or 51% of eligible voters, to elect 720 members to the European Parliament. The outcome of the elections confirmed predictions of a conservative shift across Europe, driven by Europeans’ growing frustrations with issues similar to those in the United States, including inflation, mass migration, crime, taxes, green initiatives, and NATO policy surrounding the war in Ukraine.

Unlike the U.S. Congress with just two political parties, the European Parliament has eight main parties that comprise the legislative body, all with different priorities and agendas. Over the past decade, we’ve seen a paradigm shift of Europeans leaning farther right.

Impact on France

In response to the outcome of the election, French President Emmanuel Macron dissolved the French Parliament and called for a snap election in hopes of increasing voter turnout by using the recent far-right’s victories as motivation for centrist Frenchmen.

At the time of this writing, members of the “far right” party, officially named the National Rally (NR) party, led the first of two rounds of voting, taking around 34% of the total vote. The left wing New Popular Front (NPF) won around 29% of the vote while President Macron’s Together Alliance took around 22%. What we normally see after the first round of voting are some deals between the two parties with the lower number of votes to bolster performance during the second round. A little “jockeying” if you will.

Global Perspective

This activity has been a common theme throughout the world thus far this year, most notably in Argentina, where they elected an economically ultra conservative leader last November to address the country’s desperate need for inflation relief. This has led to widespread poverty and persistently high unemployment rates. President Milei is regarded as a libertarian populist who capitalized on voter dissatisfaction with mainstream, traditional fiscal policy. His platform included proposals such as abolishing the Central Bank, replacing the Argentine peso with the U.S. dollar and dissolving numerous federal ministries. Milei’s anti-establishment rhetoric resonated with Argentinian citizens in a manner similar to Donald Trump’s 2016 campaign. Across the globe, voters are showing signs of distrust in the traditional, establishment forms of government as economic class divides continue to broaden.

Implications for the United States

So, how does all of this affect the United States? Obviously, France and the rest of Europe are our allies and close trade partners. An alignment in political ideology between the U.S. and France/EU could bolster economic trade activity, while the opposite could be true if sides are at odds. As discussed, markets perform well during gridlock, a notion not foreign to foreign markets. International developed stockholders could benefit from a divided French and European Parliament, especially when the NR’s agenda is viewed as less extreme and more of a status quo than the NPF’s.

Additionally, a 2-year-old war to the east of these NATO countries holds significant global implications. Overall, this serves as a notable “temperature check” in European sentiment, which may influence our own upcoming elections in November. We have, after all, been wrestling with similar issues since the COVID pandemic.

“2024: The Year of Elections” will be exciting, to be sure. However, as the English have wisely advised since World War II, it may be best to “Keep calm and carry on.”

This content is part of our quarterly outlook and overview. For more of our view on this quarter’s economic overview, inflation, bonds, equities and allocations, read the latest issue of Macro & Market Perspectives.

The opinions expressed within this report are those of the Investment Committee as of the date published. They are subject to change without notice, and do not necessarily reflect the views of Oakworth Capital Bank, its directors, shareholders or employees.