If you only had one word to best explain the 3rd quarter of 2024, it would be finally.

For close to two years, investors have been anticipating the start of the next Fed easing cycle. Put in layman’s terms, everyone has been waiting for the Federal Reserve to cut interest rates. Although the official economic data has arguably suggested the economy doesn’t need the Fed to do so, there has been a lot of speculation that the official data has been, shall we say, surprisingly upbeat.

In September, the Fed finally delivered. On September 18, it cut the overnight target lending rate by 50 basis points (0.50%). In some ways, this move felt sort of anticlimactic. After all, the sun still came up in the East the next morning.

But should it have? If so, just how aggressive should it be in cutting the overnight rate moving forward?

The answer to the first question is a resounding yes. While the aggregate economy is doing much better than anyone would have predicted a couple of years ago, there is a lot of secondary data and anecdotal evidence to suggest it isn’t as strong as advertised. Had the Fed waited until the numbers matched up with reality, it probably would have been too late.

As it is now, Chairman Jay Powell and company have a good chance of engineering a proverbial “soft landing.” This is when economic growth cools, but doesn’t contract, allowing businesses and consumers to regroup without retreating. While soft landings aren’t exactly unicorns, they aren’t necessarily the norm, either.

As for how aggressive the Fed should be in cutting rates moving forward? If the official inflation gauges remain subdued, it will likely take the overnight target lending rate at least into the mid-3% range. However, if the economic data comes in weaker than anticipated, a 3.0% overnight rate isn’t out of the question.

The only real question is, by when?

The safe answer is: “by the end of 2025, if not sooner.” However, the probable-case scenario is by the end of the 2nd quarter of 2025.

With that said, the markets had another great run of it this past quarter. Domestic stocks were up. International stocks – both developed and emerging – fared well. Interest rates fell, meaning bonds posted positive returns. Cash continued to pay an attractive absolute rate. Shoot, even our old friend gold, that shiny hunk of metal, soared in price.

In so many ways, for investors, it doesn’t get much better than the 3rd quarter of 2024. Everything was up in value. The economy continued to expand, even if the general public had a hard time believing it. Then, to top it off, the Fed started cutting interest rates, giving businesses and consumers a little boost in the process.

Finally.

Thank you for your continued support,

John Norris

Chief Economist

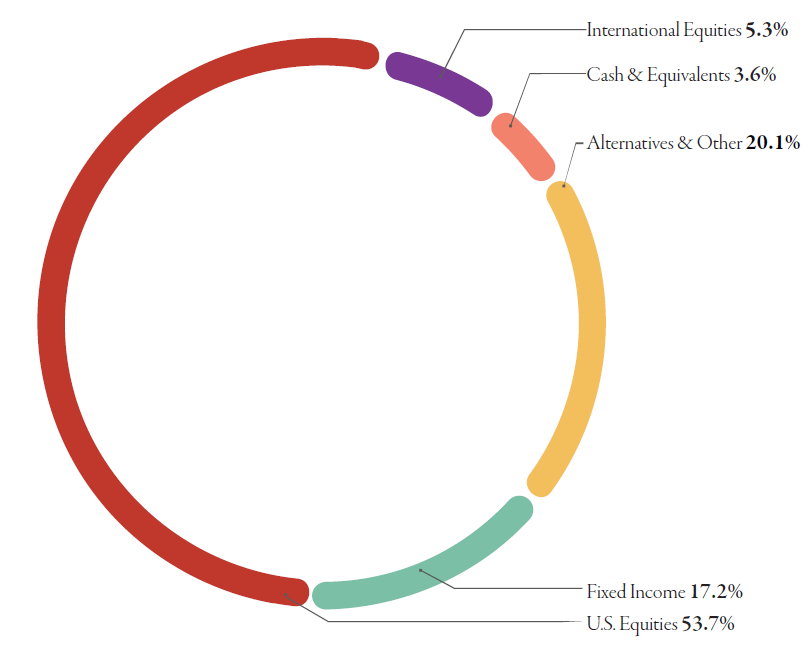

Our Investment Committee distributes information on a regular basis to better inform our clients about pending investment decisions, the current state of the economy and our forecasts for the economy and financial markets. Oakworth Capital currently advises on approximately $2.2 billion in client assets. The allocation breakdown is in the chart below.

This content is part of our quarterly outlook and overview. For more of our view on this quarter’s economic overview, inflation, bonds, equities and allocation read latest issue of Macro & Market Perspectives.

The opinions expressed within this report are those of the Investment Committee as of the date published. They are subject to change without notice, and do not necessarily reflect the views of Oakworth Capital Bank, its directors, shareholders or employees.