GROSS DOMESTIC PRODUCT

After a strong finish during the last two quarters of 2023, the U.S. economy took a little bit of a breather during the quarter. This was to be expected, but it was far from the worse-case scenario. To that end, 1st quarter 2024 Gross Domestic Product (GDP) growth should be closer to 2% than the 4% it was to end last year.

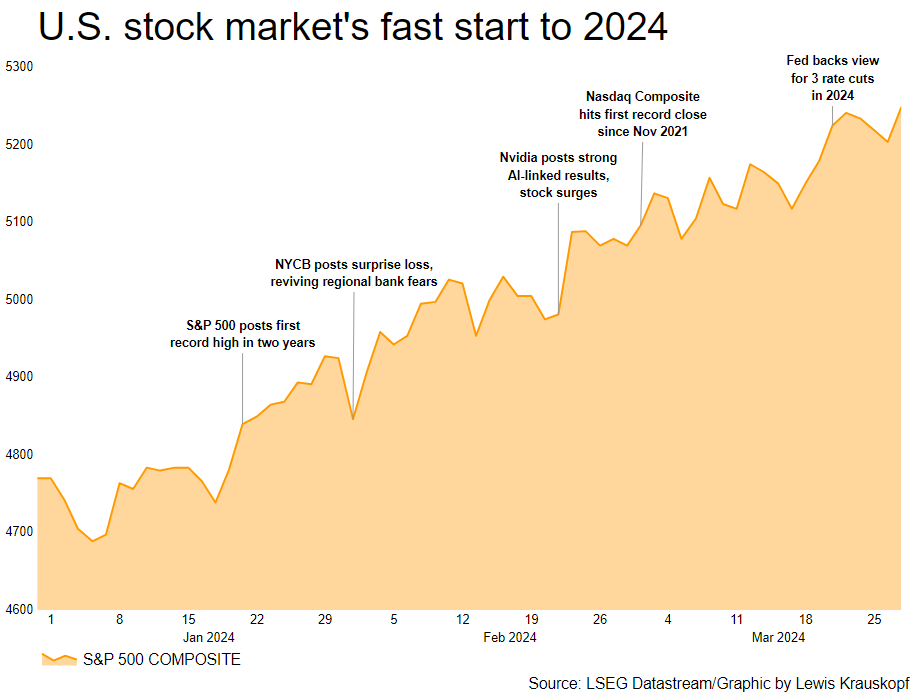

THE STOCK MARKET

Stocks sometimes struggle to start the next year. This is largely due to institutional investors rebalancing portfolios and reassessing target allocations. Someone didn’t give domestic investors the message, as U.S. stocks continued their surprisingly strong rally during the 1st quarter of 2024.

INFLATION FRUSTRATION

U.S. consumers continue to struggle with the concept of inflation coming down while prices are going up. It is important to remember inflation is the relative rate of change in prices. For example, if a product goes up $1 in price after having gone up $2 the previous period, inflation is actually coming down. However, that explanation doesn’t help when you are trying to put food on the table.

ARTIFICIAL INTELLIGENCE

The buzzword or acronym for the quarter was AI. It seemed artificial intelligence was everywhere. This is equal parts exciting, scary and creepy, but accelerated computing and AI is here to stay. So, you better learn to love it.

NVIDIA CORPORATION

Prior to 2023, a lot of Americans had never even heard of NVIDIA Corp. By the end of the 1st quarter, everyone had. That is what happens when a stock goes from $146.14, as it was on 12/31/2022, to $942.89 on 3/22/2024. Let’s just say, that is an impressive 15-month run.

MARKET DECLINE?

Stocks weren’t cheap to start the year. They were even less so by the end of the 1st quarter rally. While it is difficult to predict a market collapse, it is equally difficult to imagine the markets will continue to soar as they did at the start of 2024.

INTEREST RATES

Investors waiting for longer-term interest rates to decline to pre-2022 levels will need patience. Absent a financial system collapse or global pandemic, it is unfathomable to imagine the 10-year U.S. Treasury note falling to less than 2% during the remainder of the decade, if ever. Inflation is too entrenched, and Washington simply borrows too much money.

THE U.S. DOLLAR

The U.S. dollar continued to strengthen during the 1st quarter against other major trading currencies. The primary reason is that interest and deposit rates have remained higher for longer than people envisioned. However, the relative underperformance of the remainder of the G-7 didn’t hurt things, either.

UKRAINE

The war in Ukraine didn’t show any sign of abating during the 1st quarter. However, if Kiev doesn’t get a lot of money and material from somewhere in a hurry, the unpleasantness there should start winding down by the end of the year. Moscow is currently content to wage a war of attrition, one that the Ukrainians can’t possibly win on their own.

OAKWORTH’S PORTFOLIO

Oakworth’s Investment Committee’s predisposition would be to overweight the technology sector. However, with a price-toearnings multiple approaching levels last seen in the late 1990s, it would seem the easy money has already been made in the sector, and we have pared our weighting.

THE FEDERAL RESERVE

The markets started the quarter believing the Fed might cut the overnight rate upwards of 1.75% during 2024. They ended it convinced there will be 0.75% in cuts by the end of December. The only question remaining was/is: But when will the Fed start doing it?

THE ELECTION

For better or for worse, the presidential primaries were effectively over by the end of the first week in March. While the candidates would like to believe this is due to how compelling they are, voter apathy and resignation had much to do with it.

CRYPTO & COMMODITIES

Cryptocurrencies and precious metals also soared during the quarter. It is too early to tell if this means investors are simply excited in these asset classes or worried about others.

This content is part of our quarterly outlook and overview. For more of our view on this quarter’s economic overview, inflation, bonds, equities and allocation read latest issue of Macro & Market Perspectives.

The opinions expressed within this report are those of the Investment Committee as of the date published. They are subject to change without notice, and do not necessarily reflect the views of Oakworth Capital Bank, its directors, shareholders or employees.