When the ball dropped in Times Square on New Year’s Eve, very few people in the investment industry were sorry to see 2022 in the rearview mirror. In truth, it was one of the more frustrating years in decades for the average investor. Outside of the energy sector, and perhaps some utilities, very little worked in the markets. In truth, the best way to invest last year was to not look at the television or check your portfolio online.

In hindsight, the reason for last year’s malaise is pretty straightforward. In order to fight persistently high inflation, the Federal Reserve took the punch bowl of free money away. That didn’t surprise anyone. What did was just how sharply the markets responded to it. That interest rates were going to go up was a given. What wasn’t a given was one of the worst years in the broader domestic bond market in decades in response. That stocks would wobble as a result of higher rates was also to be expected. But the third worst year since 1974? Very few saw that coming.

Further, you can’t talk about 2022 without mentioning something about the war in Ukraine. That was a black swan event no one saw in their crystal ball. The same could be said for China’s increased bellicosity and economically stubborn approach to COVID. It was enough to make the G7, and the rest of the western world, wonder: Is everyone still playing by the rules? The short answer is no.

Finally, the United States had one of the more contentious midterm elections in memory. When the dust finally settled and smoke cleared, the GOP barely regained the House and the Democrats held onto the Senate. It was far from the much-ballyhooed “red wave,” but it will provide the United States with some much-needed political gridlock in the new year.

In the end, 2022 was one for the books, one most of us hope we won’t have to read again. However, in order to have the good, you must suffer through the bad. Last year was certainly that. So much so, I can confidently go out on a limb with my prediction for 2023: It won’t be as bad as last year.

Thank you for your continued support,

John Norris, Chief Economist & The Investment Committee

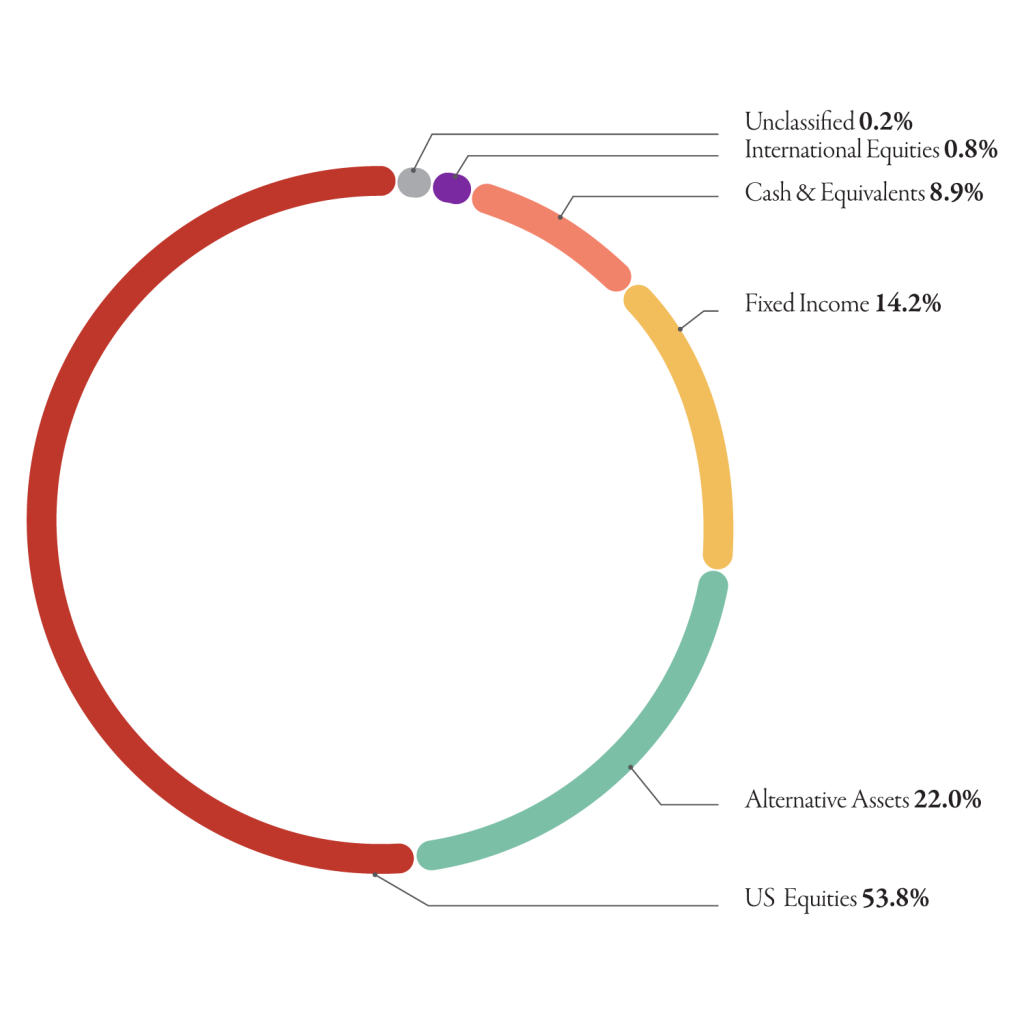

The Oakworth Capital Investment Committee distributes information on a regular basis to better inform our clients about pending investment decisions, the current state of the economy and our forecasts for the economy and financial markets. Although 2022 was a challenging year, Oakworth ended the year with $1.8 billion under advisement. The allocation breakdown is in the chart below.