The first quarter of this year may not be best described as normalcy, but at least it seems to be trending in the right direction — inflation not running near double digits, bonds not performing miserably and the same can largely be said for the stock market. Rates are still rising, and while the impacts of the hiking cycle have yet to fully unfold (outside of some banks), things seem to be settling down. The amount of fear has retreated from its highs coincidentally at the same time markets have recovered from their lows of last quarter.

This must mean we are free and clear of the most talked about recession of all time, right?

Actually, no.

In fact, the economic data has largely stabilized, if not slightly improved in some areas. So, what does this mean for our asset allocation? The most forecasted recession of all time still hasn’t happened, and the economic data has not fallen through the floor.

It seems Mr. Market hasn’t fully nailed down what the future looks like, and for market participants like us, that means opportunity.

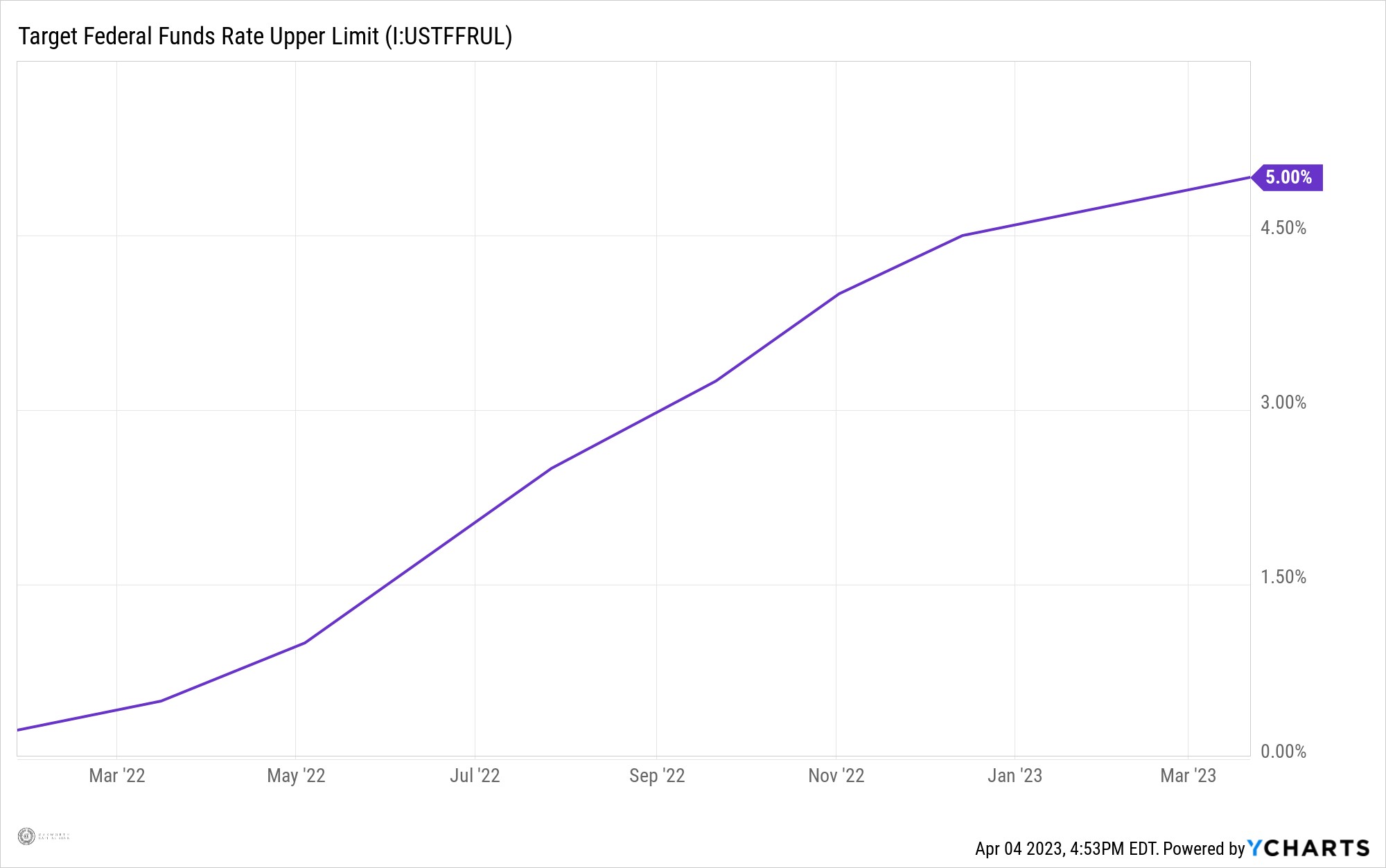

As rates rise, cash pays more. As of the end of this quarter, our wealth cash sweep is paying close to 4.5%. As I have often stated, cash is always dry powder, however when you are generating solid returns on it, it’s also a legitimate part of an asset allocation. Cash can be looped into the fixed-income part of an allocation. It’s essentially bonds with no duration risk. As the Federal Reserve moves rates higher and lower, the yield on cash will directly move with it.

TARGET FED FUNDS RATE UPPER LIMIT

Parking extra in high-yielding cash is not the worst option, and our asset allocation has backed that up, with the cash position remaining at some of the highest levels since we opened our doors. The Federal Reserve has openly stated they would like to keep rates elevated for some time and are not going to be cutting rates based on their current projections of economic activity. In layman’s terms, unless things get pretty bad, they aren’t going to slash rates.

This means that the cash allocation of our portfolio will continue to have an elevated yield and may even continue to tick up.

The market, however, is singing a completely different song. Everyone has heard about the yield curve being inverted, and that’s been the case for quite some time now. However, that inversion that is referenced is usually the 2-year Treasury versus the 10-year Treasury. What is also inverted now is the 3-month Treasury versus the 2-year Treasury. Essentially the entire yield curve is flipped upside down. The market is screaming that the Fed Funds rate will need to come down. That begs one question: Has the Fed done too much because inflation is going to continue to come down on its own, or because there is some economic pain coming that has yet to be felt?

The answer to these types of questions is usually a little bit of both.

- Inflation is clearly coming down, albeit not at the rate we would all like.

- Also, even the Federal Reserve has forecasted that to accomplish their goal, a likely consequence is slightly higher unemployment and slightly lower growth.

So, what does that mean for our allocation?

If rates likely come down at some point, it seems to make sense to keep our duration short. Shorter duration is essentially shorter-term bonds – the ones that would be most positively impacted by the Fed lowering rates. It also doesn’t hurt that the discombobulated yield curve has those shorter-term bonds paying significantly higher than long-term bonds. In some cases, by over a full percentage point.

After a painful 2022 in fixed income, one of the positives is that higher rates have allowed us to keep a slightly higher allocation toward fixed income as a whole.

Markets desire clarity arguably more than anything. Markets largely can handle rate hikes, sluggish economic data, higher than expected inflation, all that seemingly negative stuff with one caveat: when that stuff is expected. That is largely the biggest issue from 2022 – in which long-term treasuries performed even worse than the equity markets. Everyone was caught off guard by the resiliency of inflation, the fortitude of the Federal Reserve and even the strength of the U.S. economy. Everyone was caught off guard by the resiliency of inflation, the fortitude of the Federal Reserve and even the strength of the U.S. economy. This year, however, markets seem to be a little more sure footed.

Bonds have performed better as the path of inflation and rate hikes seems clearer, and equities have had a significantly better start to this year, largely I would argue, due to those same reasons.

Sure-footed, though, does not mean out of the woods. As stated earlier, the bond market is not giving the all clear, and same for the stock market. What this translates to is a largely neutral equity weighting. Not a big overweight nor underweight to the asset class. What neutral does not mean is sitting on our hands doing nothing. It allows us to maintain the upside when markets perform well, as they largely have so far this year, while also giving us the optionality to increase or decrease our overall equity weightings based on risk tolerance. It is an active choice.

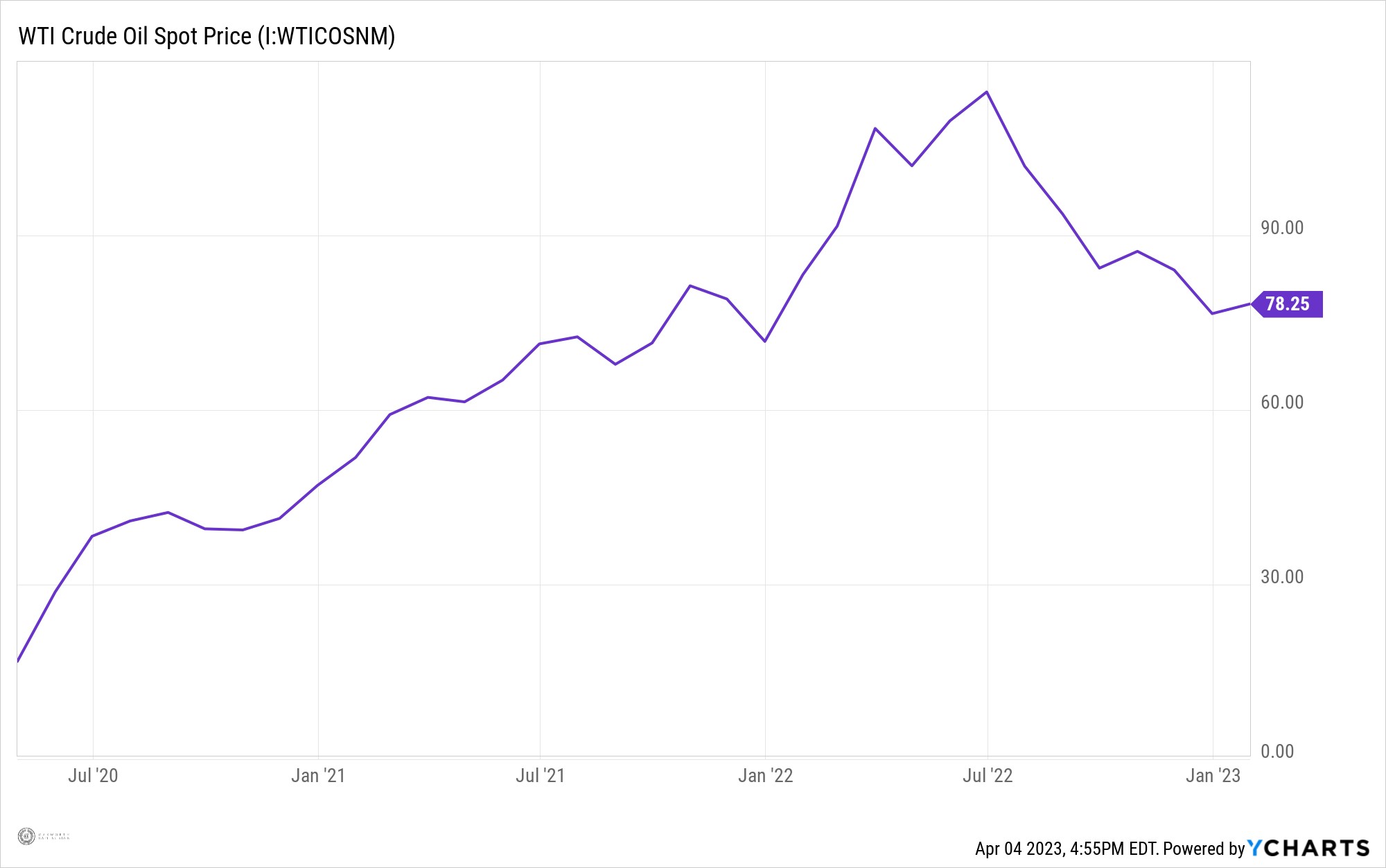

Over the last quarter there have been plenty of opportunities in the equity space. The pullback in the price of crude oil allowed us a good entry point in the exploration and production subsector of the energy market. This has accomplished several goals.

- First, we believe that the run up in crude prices over the past year has allowed a sublime transformation of the balance sheet of these largely mid cap domestic energy companies. Debt has been paid down and the capital allocation is now purely focused on returning capital to shareholders, both through buybacks and dividends. This is music to our ears, and as long as crude remains above $40 a barrel, this plan (and the music) will not stop.

- Second, the energy sector, as well as mid and small cap companies, is positioned to excel as rates start to fall. Energy is uniquely largely bought and sold in U.S. dollars across the globe, and as rates fall and the dollar subsequently weakens, it takes more dollars to purchase the same barrel. This is constructive to energy prices and affords the ability to return capital to shareholders.

CRUDE OIL SPOT PRICE

Moving from large cap to small- and mid-cap is something we have started to dip our toes into.

It’s an increasingly frequent discussion point for our Investment Committee. On top of adding to the E&P space, we also opened up a position in small cap equities by way of shareholders, both through buybacks and dividends. This is music to our ears, and as long as crude remains above $40 a barrel, this plan (and the music) will not stop. pulling from large cap equites. This maintained that neutral equity allocation while positioning ourselves for the future. As the yield curve starts to uninvert, this is likely a position that we will continue to add to.

The best thing that has happened over the past year is the optionality created in the market.

This is what any market participant loves to see. The flexibility that is allowed and the creativity available opens up the conversation and the possibilities for us to generate alpha. While we are by no means out of the woods, the first quarter of this year has been significantly better than this time last year, and opportunities continue to present themselves.

_______

This content is part of our quarterly outlook and overview. For more of our perspective on this quarter’s economy, inflation, bonds, equities and allocation, read our entire 1st Quarter 2023 Macro & Market Perspectives.